Antecedents of the Commitments of Traders (COT) reports can be traced all the way back to 1924. In that year, the U.S. Department of Agriculture’s Grain Futures Administration (predecessor to the USDA Commodity Exchange Authority, in turn the predecessor to the CFTC), published its first comprehensive annual report of hedging and speculation in regulated futures markets.

Beginning as of June 30, 1962, COT data were published each month. At the time, this report for 13 agricultural commodities was proclaimed as "another step forward in the policy of providing the public with current and basic data on futures market operations." Those original reports then were compiled on an end-of-month basis and published on the 11th or 12th calendar day of the following month.

Over the years, the CFTC has improved the Commitments of Traders reports in several ways as part of its continuing effort to better inform the public about futures markets.

- The COT report is published more often—switching to mid-month and month-end in 1990, to every two weeks in 1992, and to weekly in 2000.

- The COT report is released more quickly—moving the publication to the sixth business day after the "as of" date in 1990 and then to the third business day after the "as of" date in 1992.

- The report includes more information—adding data on the numbers of traders in each category, a crop-year breakout, and concentration ratios in the early 1970s; data on option positions in 1995; and a Supplemental report in 2007 showing positions of Index Traders in selected agricultural markets.(Comprehensive Review of the Commitments of Traders Reporting Program and an Executive Summary)

- The report also is more widely available—moving from a subscription-based mailing list to fee-based electronic access in 1993, and, beginning in 1995, becoming freely available on CFTC.gov.

- The report also is more widely available—moving from a subscription-based mailing list to fee-based electronic access in 1993, and, beginning in 1995, becoming freely available on CFTC.gov.

- In October 2022, the COT report is made available in a public reporting environment which allows users to search, filter, customize and download report data.

The COT reports provide a breakdown of each Tuesday's open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. The weekly reports for Futures-Only Commitments of Traders and for Futures-and-Options-Combined Commitments of Traders are released every Friday at 3:30 p.m. Eastern time.

Reports are available in both a short and long format. The short report shows open interest separately by reportable and nonreportable positions. For reportable positions, additional data is provided for commercial and non-commercial holdings, spreading, changes from the previous report, percents of open interest by category, and numbers of traders.

The long report, in addition to the information in the short report, also groups the data by crop year, where appropriate, and shows the concentration of positions held by the largest four and eight traders. The Supplemental report is published for Futures-and-Options-Combined in selected agricultural markets and, in addition to showing all the information in the short format, shows positions of Index Traders.

Current and historical Commitments of Traders data is available on CFTC.gov, as is historical COT data going back to 1986 for Futures-Only reports, to 1995 for option-and-futures-combined reports, and to 2006 for the Supplemental report.

How to Read the Commitments of Traders reports

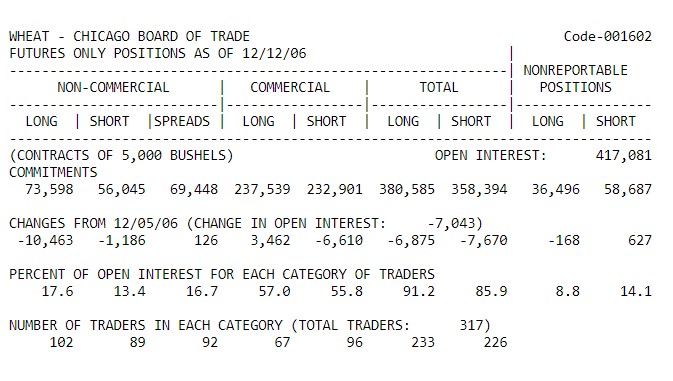

This sample is from the December 12, 2006, COT report (short format), published in the traditional format, showing data for the Chicago Board of Trade's (CBT) wheat futures contract.

Figure 1. CFTC.gov sample of COT Futures Only Chicago Board of Trade (short form); December 12, 2006

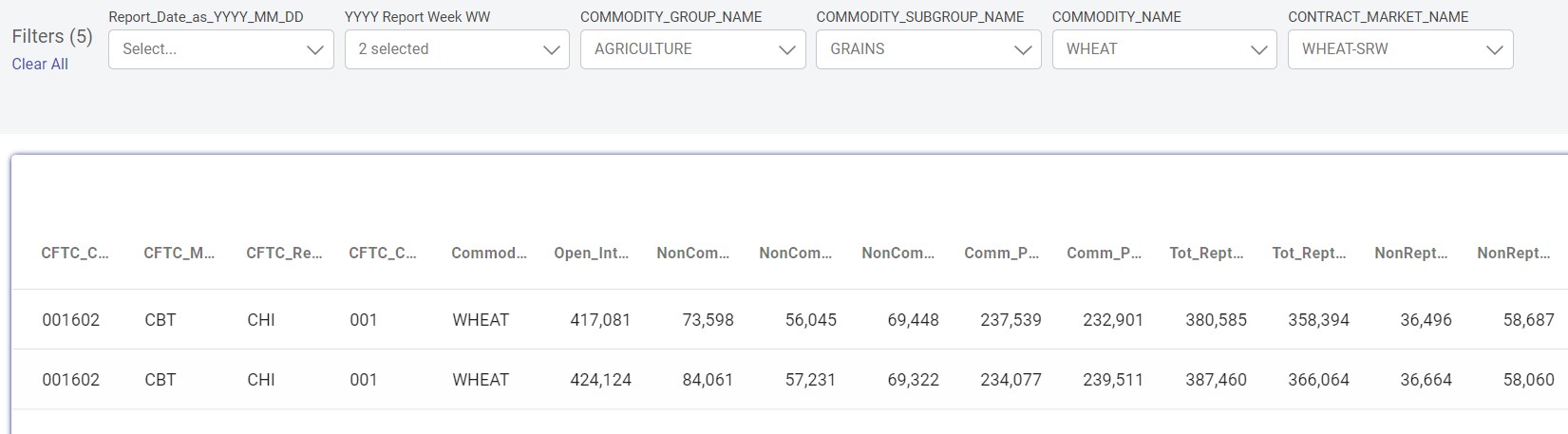

This is a sample of the same data reported for the CBT’s wheat futures contract in the CFTC Public Reporting Environment with the following filters applied:

Report Date as YYYY_MM-DD: 2 selected (2006 Report Week 50; 2006 Report Week 49)

- Commodity Group Name: Agriculture

- Commodity Subgroup Name: Grains

- Commodity Name: Wheat

- Commodity Market Name: Wheat-SRW

Figure 2. PRE sample of COT Futures Only Chicago Board of Trade (short form); December 12, 2006

See the Commitments of Traders Explanatory Notes.