- Information

Technology - Customer

Protection

Commissioners- Inspector

General - Industry

Regulation- The Commission and the Industry We Regulate

- Industry Growth in Volume, Globalization and Complexity

- Growth in Volume of Futures and Option Contracts Traded

- Estimated Annual Swap Event Volume

- Actively Traded Futures and Option Contracts

- Notional Value of Futures/Option Open Contracts

- Notional Value of Exchange-Traded and OTC Contracts

- Customer Funds in Futures Commission Merchants Accounts

- Aggregate Sum of House Origin Margin on Deposit

- Number of Registrants

- Contract Markets Designated by the CFTC

- Number of DCOs Registered with the CFTC

- Exempt Markets

- Industry

Trends- Industry Trends and CFTC Resource Requirements

- Industry Trend 1: Swap Markets are Increasingly Operating Under the Dodd-Frank Regulatory Framework

- Industry Trend 2: Increased Number of Market Participants is Driving Innovation in Derivatives Trading

- Industry Trend 3: Intermediaries are Investing in New Business Processes and Technology

- Industry Trend 4: Heightened Risk Management Practices Seek to Lower Institutional Risk at Clearinghouses

- Industry Trend 5: Market Participants Need to Manage Large Volumes of Data in Order to Adapt to Evolving Derivatives Environment

- Resources

by Goal - Privacy

Policy

Acronyms

Goal Two: Protect the public and market participants by ensuring the financial integrity of derivatives transactions, mitigation of systemic risk, and the fitness and soundness of intermediaries and other registrants.

In fostering financially sound markets, the Commission's main priorities are to avoid disruptions to the system for clearing and settling contract obligations and to protect the funds that customers entrust to FCMs. Clearing organizations and FCMs are integral to the financial integrity of derivatives transactions – together, they protect against the financial difficulties of one trader becoming a systemic problem. Several aspects of the regulatory framework that contribute to the Commission achieving Goal Two are: 1) requiring that market participants post margin to secure their ability to fulfill financial obligations; 2) requiring participants on the losing side of trades to meet their obligations, in cash, through daily (sometimes intraday) margin calls; 3) requiring FCMs to maintain minimum levels of operating capital; and, 4) requiring FCMs to segregate customer funds from their own funds.

The Commission works with the exchanges and the NFA to closely monitor the financial condition of the FCMs themselves, who must provide the Commission, exchanges and NFA with various monthly and annual financial reports. The exchanges and NFA conduct routine, periodic audits and daily financial surveillance of their respective member FCMs. As a regulator, the Commission reviews the audit and financial surveillance programs of the exchanges and NFA and also monitors the financial condition of FCMs directly, as appropriate. This includes reviewing each FCM's exposure to risk from large customer positions that it carries. The Commission also conducts extensive daily surveillance of risks posed by traders, firms and DCOs and periodically reviews clearing organization procedures for monitoring risks and protecting customer funds.

The Commission works with the NFA to ensure that those seeking registration as intermediaries meet high qualification and fitness standards through the registration process. The Commission also drafts and interprets rules that apply to the conduct of business by these intermediaries.

With the implementation of the Dodd-Frank Act, the Commission has substantially greater responsibilities, including oversight of newly registered derivatives dealers, as well as implementation of enhanced compliance requirements for intermediaries and new core principle requirements for DCOs. The Commission also will be responsible for determining the initial eligibility or the continuing qualification of a DCO to clear swaps, as well as for the review of swaps submitted to the Commission for a determination as to whether the swaps are required to be cleared. The Commission also will be implementing new statutory provisions regarding review of new rules and rule amendments submitted by DCOs. In addition, the scope of the Commission's reviews of DCOs, DSROs, and intermediaries will be expanded to include swap transactions and swap intermediaries.

| Mission Activities | FY 2013 | FY 2014 | Change | |||

|---|---|---|---|---|---|---|

| Budget | FTE | Budget Request | FTE | Budget | FTE | |

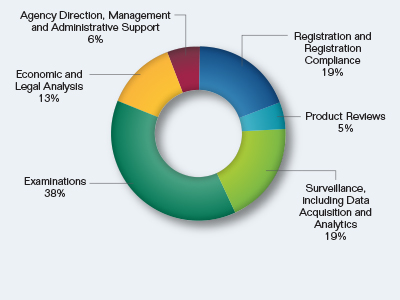

| Registration and Registration Compliance | $14,120 | 54 | $16,920 | 65 | $2,800 | 11 |

| Product Reviews | 4,940 | 19 | 4,770 | 18 | -170 | -1 |

| Surveillance, including Data Acquisition and Analytics | 16,190 | 54 | 16,210 | 51 | 20 | -3 |

| Examinations | 26,980 | 115 | 32,900 | 138 | 5,920 | 23 |

| Enforcement | 0 | 0 | 0 | 0 | 0 | 0 |

| Economic and Legal Analysis | 10,980 | 45 | 11,160 | 45 | 180 | 0 |

| International Policy Coordination | 230 | 1 | 0 | 0 | -230 | -1 |

| Data Infrastructure and Technology Support | 0 | 0 | 0 | 0 | 0 | 0 |

| Agency Direction, Management and Administrative Support | 5,160 | 22 | 5,010 | 21 | -150 | -1 |

| Total Goal Two | $78,600 | 310 | $86,970 | 338 | $8,370 | 28 |

Breakout of Goal Two Request by Mission Activity

| FY 2013 | FY 2014 | Change | ||||

|---|---|---|---|---|---|---|

| Budget | FTE | Budget Request | FTE | Budget | FTE | |

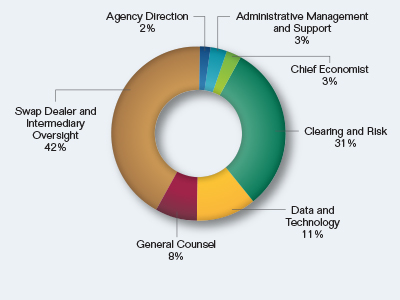

| Agency Direction | $2,110 | 9 | $1,910 | 8 | -$200 | -1 |

| Administrative Management and Support | 3,050 | 13 | 3,100 | 13 | 50 | 0 |

| Chief Economist | 3,050 | 13 | 2,620 | 11 | -430 | -2 |

| Clearing and Risk | 23,920 | 102 | 26,940 | 113 | 3,020 | 11 |

| Data and Technology | 8,960 | 13 | 9,250 | 12 | 290 | -1 |

| Enforcement | 0 | 0 | 0 | 0 | 0 | 0 |

| General Counsel | 7,030 | 30 | 6,680 | 28 | -350 | -2 |

| International Affairs | 0 | 0 | 0 | 0 | 0 | 0 |

| Inspector General | 0 | 0 | 0 | 0 | 0 | 0 |

| Market Oversight | 0 | 0 | 0 | 0 | 0 | 0 |

| Swap Dealer and Intermediary Oversight | 30,480 | 130 | 36,470 | 153 | 5,990 | 23 |

| Total | $78,600 | 310 | $86,970 | 338 | $8,370 | 28 |

Breakout of Goal Two Request by Division