- Information

Technology - Customer

Protection

Commissioners- Inspector

General - Industry

Regulation- The Commission and the Industry We Regulate

- Industry Growth in Volume, Globalization and Complexity

- Growth in Volume of Futures and Option Contracts Traded

- Estimated Annual Swap Event Volume

- Actively Traded Futures and Option Contracts

- Notional Value of Futures/Option Open Contracts

- Notional Value of Exchange-Traded and OTC Contracts

- Customer Funds in Futures Commission Merchants Accounts

- Aggregate Sum of House Origin Margin on Deposit

- Number of Registrants

- Contract Markets Designated by the CFTC

- Number of DCOs Registered with the CFTC

- Exempt Markets

- Industry

Trends- Industry Trends and CFTC Resource Requirements

- Industry Trend 1: Swap Markets are Increasingly Operating Under the Dodd-Frank Regulatory Framework

- Industry Trend 2: Increased Number of Market Participants is Driving Innovation in Derivatives Trading

- Industry Trend 3: Intermediaries are Investing in New Business Processes and Technology

- Industry Trend 4: Heightened Risk Management Practices Seek to Lower Institutional Risk at Clearinghouses

- Industry Trend 5: Market Participants Need to Manage Large Volumes of Data in Order to Adapt to Evolving Derivatives Environment

- Resources

by Goal - Privacy

Policy

Acronyms

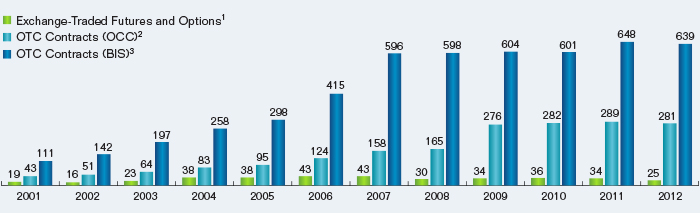

The commodity swaps market, which has an outstanding notional value of $2,993 billion at the first half of 2012, according to the Bank for International Settlements (BIS), is the smallest sector of the overall swaps market comprising only 0.5 percent of the $639 trillion total notional value.

Notional Value of Exchange-Traded and OTC Contracts

Amount in Trillions

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Exchange-Traded Futures and Options1 | 19 | 16 | 23 | 38 | 38 | 43 | 43 | 30 | 34 | 36 | 34 | 25 |

| OTC Contracts (OCC)2 | 43 | 51 | 64 | 83 | 95 | 124 | 158 | 165 | 276 | 282 | 289 | 281 |

| OTC Contracts (BIS)3 | 111 | 142 | 197 | 258 | 298 | 415 | 596 | 598 | 604 | 601 | 648 | 639 |

1 Exchange-Traded Futures/Options are those traded on CFTC Designated Contract Markets. (back to text)

2 Office of the Comptroller of the Currency (OCC) data is for the top 25 bank holding companies with the most derivative contracts and “OTC” includes: Forwards, Swaps, Options, and Credit Derivatives. The value for 2012 is as of end-September. (back to text)

3 Bank of International Settlements (BIS) OCT data includes “Foreign Exchange, “Interest Rates”, “Equity-linked”, “Commodity”, “Credit Default Swaps”, and “Unallocated” contracts. The value for 2012 is as of end-June. (back to text)