- Overview of the FY 2014 Budget & Performance Plan

- Summary of FY 2014 Budget Request by Mission Activity

- Summary of FY 2014 Budget Request by Division

- Summary of FY 2014 Budget Request by Object Class

- Crosswalk from FY 2013 Budget to FY 2014 Request

- Crosswalk from FY 2013 Continuing Resolution to FY 2014 Request

- Statement of Availability on Basis of Obligations

- Statement of Availability on Basis of Appropriation by Program

- Mission Activities

- Divisions

The Division of Clearing and Risk (DCR) program oversees the clearing of futures, options on futures, and swaps by DCOs and other market participants that may pose risk to the clearing process including FCMs, swap dealers, major swap participants and large traders. The DCR staff prepare proposed regulations, orders, guidelines, and other regulatory work products on issues pertaining to DCOs; review DCO applications and rule submissions and make recommendations to the Commission; make determinations and recommendations to the Commission as to which types of swaps should be required to be cleared; make determinations and recommendations to the Commission as to the initial eligibility or continuing qualification of a DCO to clear swaps; assess compliance by DCOs with the CEA and Commission regulations, including examining systemically important DCOs at least once a year; and conduct risk assessment and financial surveillance to identify, quantify, and monitor the risks posed by DCOs, clearing members, and market participants and its financial impact.

Registration

Registration of Derivatives Clearing Organizations, Rules Review, Applications for Portfolio Margining. Staff is required to review, evaluate and make recommendations to the Commission on applications for DCO registration and rule filings submitted by registered DCOs. Moreover, pursuant to Section 806(e) of the Dodd-Frank Act, certain rule changes for DCOs that have been designated as systemically important pursuant to Title VIII are subject to enhanced standards of review, which standards require coordination with the Board of Governors of the Federal Reserve. Further, the Dodd-Frank Act amended the CEA to permit, pursuant to an exemption, rule or regulation, futures and options on futures to be held in a portfolio margining account that is carried as a securities account and approved by the Securities and Exchange Commission, and added a reciprocal provision to the Securities Exchange Act of 1934. The Commission will be required to process portfolio margining applications in accordance with these statutory provisions, as well as in response to requests relating to commingling and portfolio margining of swaps and security-based swaps. On average, these applications take about six months to one year to process.

Product Review

Mandatory Clearing Determination. The Dodd-Frank Act imposed a new requirement on the CFTC to review, evaluate, and make a determination concerning whether a swap or class of swaps should be required to be cleared — i.e., a mandatory clearing determination — as well as evaluate the continuing qualification of a DCO to clear such a swap. Data from the Bank for International Settlements indicates that the total notional amount of over-the-counter derivatives outstanding as of the end of June 2012 was $494 trillion for interest rates; $26.9 trillion for credit default swaps and $3 trillion for commodities. Staff is required by the CEA to continue reviewing swaps that are offered for clearing by DCOs.

Surveillance, Including Data Acquisition and Analytics

Risk Surveillance of Futures, Options and Cleared Swaps. The CFTC will have to conduct risk surveillance of futures, options and cleared swaps. It is estimated that the notional value of cleared swaps that will require surveillance is about seven times that of futures and options. This responsibility will be discharged through the use of automated surveillance systems and applications and other risk assessment tools to assess, evaluate and report financial and market risk and risk management procedures at DCOs, clearing FCMs, non-futures commission merchant clearing participants, and other market participants that may pose a risk to the clearing process, including swap dealers, major swap participants, and large traders.

The Commission's current financial and risk surveillance applications were designed to address futures and options on futures products. Unlike futures margin setting where each DCO uses the same application to margin positions, each DCO margining swaps positions will be using a unique margin methodology and a unique way to stress test positions. Futures and swaps risk management software will be implemented to enable the CFTC to analyze margin requirements; determine price impact on portfolios; conduct margin trend analyses and back testing; and stress test swaps positions—including interest rate swaps, energy swaps and credit default swaps.

Examinations

The Dodd-Frank Act requires annual examinations of systemically important DCOs. DCOs that are determined to be systemically important under Title VIII of the Dodd-Frank Act must comply with heightened risk management and prudential standards concerning payment, clearing, and settlement supervision. The mandatory annual examinations of systemically important DCOs must review the entities' adherence to these heightened standards. Title VIII also requires ongoing consultation between the CFTC, the SEC, and the Board of Governors of the Federal Reserve System, including the scope and methodology of planning examinations of systemically important entities. The Commission currently anticipates no more than four entities will be determined to be systemically important. As of the writing of this report, the Commission is the Supervisory Agency (primary regulator) for two DCOs that have been determined to be systemically important.

To implement the Dodd-Frank Act, CFTC regulations were amended to impose new requirements on DCOs to provide quarterly financial reporting, annual year-end financial statements, and various other reports. Staff will need to review these submissions and evaluate compliance with the CEA and the implementing regulations for all of these reports.

Economic and Legal Analysis

Interpretation and Guidance. Market participants will have requests for clarification and guidance once the new regulations are adopted and during the implementation period. Based on experience over the years with the implementation of other new registration schemes (e.g., for CPOs and CTAs, for IBs, and for RFEDs), there are bound to be questions arising that need a response. While some of these responses may be informal, by way of email or telephonic discussion, many will need to be formal, by way of a staff-issued interpretative, no-action or exemptive letter or a Commission-issued order or regulation (or amendment thereto). Also, because many of these issues will be questions of first impression, the time taken to provide responses to the issues will be longer than it is today. The Commission also anticipates the need to be actively involved in the preparation of interpretations relating to jurisdictional issues arising under the Dodd-Frank Act amendments to the CEA. Timeliness is key to minimizing disruption to the orderly workings of the marketplace.

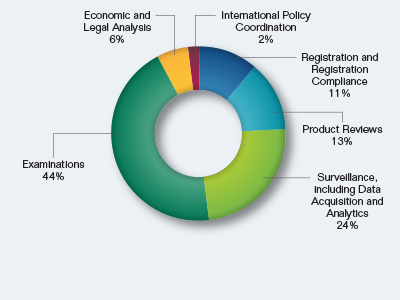

FY 2014 Budget Overview by Mission Activity

| FTE | Salaries and Expenses | IT | Total | |

|---|---|---|---|---|

| Registration and Registration Compliance | 13 | $3,100 | $0 | $3,100 |

| Product Reviews | 15 | 3,580 | 0 | 3,580 |

| Surveillance, including Data Acquisition and Analytics | 28 | 6,680 | 0 | 6,680 |

| Examinations | 50 | 11,920 | 0 | 11,920 |

| Economic and Legal Analysis | 7 | 1,670 | 0 | 1,670 |

| International Policy Coordination | 2 | 480 | 0 | 480 |

| Total | 115 | $27,430 | $0 | $27,430 |

Clearing and Risk Request by Mission Activity

Top FY 2012 Accomplishments

Led rulemaking initiatives to develop regulations mandated by the Dodd-Frank Act in the following areas: segregation and bankruptcy; DCO core principles; governance and possible limits on ownership and control; systemically important DCO rules authorized under Title VIII; portfolio margining procedures; conforming rules; client clearing documentation; clearing member risk management; and end-user exception to the clearing requirement.

Worked with DCOs to facilitate implementation of new statutory and regulatory requirements, through individual discussions as well as a series of informational memoranda that were distributed to all registered DCOs.

Proposed and finalized clearing requirement rules for four classes of interest rate swaps and two classes of credit default swaps; finalized implementation schedule for mandatory clearing.

Led team drafting proposed exemption, pursuant to Section 722(f) of the Dodd-Frank Act, for Financial Transmission Rights traded through Regional Transmission Organizations and Independent System Operators.

Led efforts of Designations Committee of the Financial Stability Oversight Council staff to designate two DCOs as systemically important pursuant to Title VIII of the Dodd-Frank Act.

Initiated and completed fieldwork for the examination of one systematically important DCO – ICE Clear Credit LLC - and initiated and completed fieldwork for the following examinations of other DCOs - New York Portfolio Clearing LLC, LCH.Clearnet Ltd. and MGE Clearing House – to evaluate their compliance with the CEA and Commission regulations, including applicable Core Principles. Completed examination reports for Chicago Mercantile Exchange Inc. and ICE Clear Credit LLC.

Received, reviewed, and evaluated compliance for the DCO quarterly financial reports. In addition, staff wrote business requirements for systems development regarding these filings.

Developed an application to value collateral on deposit at DCOs.

Worked in coordination with foreign regulatory authorities to promulgate consistent international standards for central counterparties (such as DCOs) and other financial market infrastructures serving swaps (the CPSS-IOSCO Principles for Financial Market Infrastructures).

Worked with staff of the FDIC to develop coordinated approaches to central counterparty clearing issues in Resolution pursuant to Title II of the Dodd-Frank Act.

Led Commission efforts in addressing impacts of two commodity broker bankruptcies.

Developed a program to review the risk management policies and procedures of clearing firms.

Conducted reviews of largest long equity position holders to understand how money flows between pensions, trustees, money managers and clearing members.

Enhanced interest rate swaps and credit default swaps risk surveillance abilities.

Put a near real time program in place to survey clearing members on an ongoing basis regarding resources available to them to pay record variation amounts.

Top FY 2013 President's Budget & Performance Planned Outcomes

Complete and issue final regulations mandated by Dodd-Frank Act in the following regulatory areas: segregation and bankruptcy; DCO core principles; governance and possible limits on ownership and control; systemically important DCO rules authorized under Title VIII; portfolio margining procedures; conforming rules; client clearing documentation; and clearing member risk management.

As required under the Dodd-Frank Act, consult with the Board of Governors of the Federal Reserve System regarding the scope and methodology prior to each examination of a systematically important DCO for which the CFTC is the supervisory agency. Coordinate document requests and on-site review activities with all regulatory agencies that are participating in the examination.

Initiate and complete fieldwork for examinations of the two systematically important DCOs for which the CFTC is the supervisory agency to evaluate their compliance with the CEA and Commission regulations, including applicable Core Principles. Also evaluate their compliance with heightened risk management, prudential standards concerning payment, clearing and settlement supervision.

Initiate and complete fieldwork for examinations for two other DCOs to evaluate their compliance with the CEA and Commission regulations, including applicable core principles.

Work with ODT on automation of the examination process (requirements stage).

Complete and issue report of findings on examinations of DCOs commenced in FY 2011 and 2012.

Review and evaluate quarterly DCO filings, annual filings, and event specific filings for compliance with the CEA. Develop technology solutions to file the information with the Commission and a tool to aid in the review of the filings.

Complete the review of applications for registration as a DCO from Eurex Clearing AG to clear swaps and from LCH.Clearnet SA to clear credit default swaps and make recommendations to the Commission as to whether registration should be granted.

Implement final clearing requirement rules for four classes of classes of interest rate swaps and two classes of credit default swaps; continue to review, evaluate and make determinations concerning the mandatory clearing of swaps from product categories such as interest rate and currency products, credit and equity products, and commodity products.

Finalize exemption pursuant to CEA §4(c)(6) for Regional Transmission Organizations operating pursuant to Federal Energy Regulatory Commission and Public Utility Commission of Texas Tariffs.

Review DCOs that clear swaps to evaluate and to make determinations concerning the acceptance of a swap for clearing on the DCO as to its eligibility or continuing qualification of the DCO to clear such a swap.

Review, evaluate and make determinations concerning portfolio margining applications, including the review and assessments of margin models, methodologies, and systems used by DCOs for purposes of calculating margin requirements and monitoring and managing risk.

Review, evaluate and make determinations concerning requests to commingle futures and swaps positions pursuant to DCO rules or Commission 4d order and concerning quarterly financial resource reports filed by each DCO.

Respond to public and industry requests for interpretation concerning regulations governing DCO core principles, segregation and bankruptcy, and risk management.

Work, in coordination with foreign regulatory authorities, to develop consistent international standards for resolution of central counterparties and other financial market infrastructures serving swaps markets.

Work, in coordination with foreign regulatory authorities, to develop consistent international standards for capital treatment of bank exposures to central counterparties.

Develop and implement risk assessment and evaluation application tools necessary to evaluate on an ongoing basis the risk of new cleared swap contracts, including the capacity to identify required data to be transmitted by the appropriate market participants, to identify the enhancements that will required of existing risk surveillance applications, and to identify third party software that may be appropriate for these tasks.

Put in place a program to back test DCO margin adequacy for futures and swaps at the product and portfolio level.

Execute 15 reviews of clearing member risk management policies and procedures.

Top FY 2014 President's Budget & Performance Planned Outcomes

Develop and issue rulemakings, orders, interpretations, and other regulatory work product related to DCOs, clearing, and product review.

Continue to review, evaluate and make determinations concerning the mandatory clearing of swaps from product categories such as interest rate and currency products, credit and equity products, and commodity products.

Review, evaluate and make determinations concerning portfolio margining applications, including the review and assessments of margin models, methodologies, and systems used by DCOs for purposes of calculating margin requirements and monitoring and managing risk.

As required under the Dodd-Frank Act, consult with Board of Governors of the Federal Reserve Bank (FRB) regarding the scope and methodology prior to each examination of systematically important DCOs where the CFTC is the primary regulator. Coordinate document requests and meeting requests with all regulatory agencies that are participating in the examination.

Initiate examinations of DCOs that are determined to be systemically important, i.e., designated clearing entities, to evaluate their compliance with heightened risk management, prudential standards concerning payment, clearing and settlement supervision, and advance notice of changes to their rules, procedures, or operations.

The Examination Branch will attempt to use its limited resources in the most efficient manner possible and will determine which of the DCOs should be reviewed based on the highest need and greatest risk. Initiate examination of four other DCOs to evaluate their compliance with the CEA and Commission regulations, including applicable Core Principles. Write business requirements for tools that would aid staff in the examination process.

Review and evaluate quarterly DCO filings, annual filings, and event-specific filings for compliance with the CEA and Commission regulations, in particular, Part 39.

Respond to public and industry requests for interpretation concerning regulations governing DCO core principles, segregation and bankruptcy, and risk management.

Work in coordination with foreign regulatory authorities to evaluate compliance with the CPSS-IOSCO Principles for Financial Market Infrastructures.

Review, evaluate and make determinations concerning requests to commingle futures and swaps positions pursuant to DCO rules or Commission 4d Order.

Develop procedures for conducting firm-level stress testing across all registered DCOs.

Review, evaluate and make determinations concerning applications for registration as a DCO.