- Overview of the FY 2014 Budget & Performance Plan

- Summary of FY 2014 Budget Request by Mission Activity

- Summary of FY 2014 Budget Request by Division

- Summary of FY 2014 Budget Request by Object Class

- Crosswalk from FY 2013 Budget to FY 2014 Request

- Crosswalk from FY 2013 Continuing Resolution to FY 2014 Request

- Statement of Availability on Basis of Obligations

- Statement of Availability on Basis of Appropriation by Program

- Mission Activities

- Divisions

Examinations are formal, structured assessments of regulated entities' operations or oversight programs to assess on-going compliance with statutory and regulatory mandates. Regular examinations are the most effective method of ensuring that the entities' are complying with the core principles established in the CEA (as amended):

- Reviews of DCMs, SEFs and SDRs focus on the structural sufficiency of their self-regulatory and compliance programs.

- Examinations of DCOs' compliance with core principles, and regulations implementing such core principles, to ensure the soundness of the financial condition of those entities. The Commission is required to examine SIDCOs at least annually.

- Reviews of registered intermediaries ensure compliance with mandated standards regarding the fitness and conduct necessary to ensure the protection of market participants and the financial soundness of the market.

- Examinations of FCMs' and retail foreign exchange dealers' (RFEDs') compliance with applicable capital, segregation, and financial reporting requirements help ensure that markets are protected from systemic risk and that the funds belonging to customers are protected from loss.

- Oversight of the financial surveillance and compliance programs of SROs (the exchanges and registered futures associations (RFAs)) are designed to ensure that the SROs are effectively monitoring the financial integrity of market intermediaries and protecting customer funds.

Examinations are performed by multi-disciplinary teams of attorneys, industry economists, trade practice analysts, risk analysts and accountants depending on the scope. As described in Goal Two of the Strategic Plan, it is the Commission's goal to move to annual reviews of significant entities, to ensure the effectiveness of Commission regulations.

- The Commission anticipates performing routine annual examinations of the largest DCMs, SEFs, SDRs, and DCOs, with reviews of the less risky entities every two to three years as resources are available. The ability to perform the biennial or triennial reviews will depend, in part, on the number of "for cause" examinations the Commission must undertake in a given time.

- The Commission is seeking an increase in FY 2014 for examinations, driven primarily by allocating increased resources to ensure that SEFs, SDRs, MSPs, FCMs, SIDCOs and other entities comply with the applicable core principles set forth in the CEA and Commission regulations, including:

- Direct compliance examinations of DCMs, SDRs, SEFs, and DCOs;

- Direct compliance examinations for FCMs and DSROs, and oversight/annual performance assessments of SRO financial surveillance programs;

- Evaluations of NFA methodologies and processes for monitoring CPO and CTA compliance with CEA and Commission regulations;

- Daily financial surveillance of market activities and associated reporting;

- Continuous industry and stakeholder engagement, communications, and relationship building; and

- Development and promotion of best practices standards including data standards and data quality.

- The Commission anticipates being able to redeploy staff from the 2013 surge in registration and product review related activities, and from the increased efficiency in surveillance to the critically important examinations activity. As indicated above, this increase supports the expanded examinations of entities in the CFTC's traditional markets as well as the inclusion of new entities under the Dodd-Frank Act.

Summary

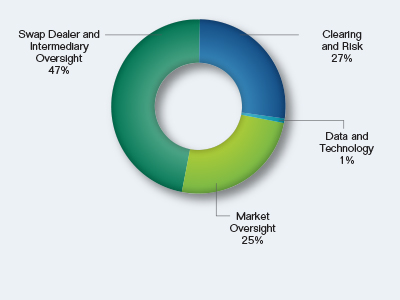

Organizationally, the Commission's examinations-related resources will support the requirements of four Divisions:

| FTE | Salaries and Expenses | IT | Total | |

|---|---|---|---|---|

| Clearing and Risk | 50 | $11,920 | $0 | $11,920 |

| Data and Technology | 0 | 0 | 210 | 210 |

| Market Oversight | 47 | 11,210 | 0 | 11,210 |

| Swap Dealer and Intermediary Oversight | 88 | 20,980 | 0 | 20,980 |

| Total | 185 | $44,110 | $210 | $44,320 |

Examinations Request by Division