- Overview of the FY 2014 Budget & Performance Plan

- Summary of FY 2014 Budget Request by Mission Activity

- Summary of FY 2014 Budget Request by Division

- Summary of FY 2014 Budget Request by Object Class

- Crosswalk from FY 2013 Budget to FY 2014 Request

- Crosswalk from FY 2013 Continuing Resolution to FY 2014 Request

- Statement of Availability on Basis of Obligations

- Statement of Availability on Basis of Appropriation by Program

- Mission Activities

- Divisions

The Commission performs three broad types of surveillance: market, financial and risk, and business analytics.

Market surveillance

The Commission monitors trading and positions of market participants on an on-going basis. Commission staff screen for potential market manipulations and disruptive trading practices, as well as trade practice violations. Staff also monitors changing market conditions and developments, such as shifting patterns of commercial or speculative trading or the introduction of new trading activities, to assess possible market impacts on internal review techniques and/or evaluate the impact such changes may have on exchange trading rules and contracts.

Market oversight and surveillance activities are dependent on the ability to acquire large volumes of data and the development of sophisticated analytics to identify trends and/or outlying events that warrant further investigation. To the extent possible, the CFTC is seeking to leverage applications and analysis across the organization through the use of standardized data sets. It is anticipated that through the collection of standardized data sets, the Commission will have the unique and essential ability to aggregate data received by all market participants. This aggregation will give the Commission a more encompassing view of futures, options and swaps transactions, which will, in turn, allow the Commission to conduct market-level surveillance and perform financial risk analyses of market participants. This capability is particularly important with the expansion of the Commission's mandate in the disaggregated swaps markets, as market participants may have swaps data residing in multiple SDRs, multiple DCMs, and multiple SEFs. The Commission's ability to view aggregated data across the industry landscape is essential. Investment in information technology (IT) is mandatory for this aggregation and also supports all facets of Commission market, financial, and risk surveillance activities. Furthermore, to address this need the Commission established a Strategic Plan objective to ensure that information technology systems support the Commission's existing and expanded responsibilities to ensure financially sound markets, mitigate systemic risk, and monitor intermediaries.

The analytic tools for surveillance are designed to improve the efficiency and effectives of the Commission's activities across dimensions:

- Staff analyses can focus on developing new surveillance approaches that will be subsequently operationalized, and

- Potential violations will be recorded, tracked and referred to other divisions (e.g., enforcement) to ensure appropriate follow-up.

The Commission anticipates building upon the enhanced surveillance capability. Further, as trading across the world's marketplaces has moved almost entirely to electronic systems, the Commission must handle unprecedented volumes of transactions that occur in a matter of milliseconds. In FY 2014, the Commission will leverage its 2013 investments in high performance computing to process specific product and time based message data, which will facilitate analysis and investigations of anomalous activity. The Commission anticipates a reduction in the number of staff years devoted to surveillance, including data acquisition and analytics, and surveillance activities, with a commensurate decrease in funding. These proposed reductions result from actions begun in FY 2012 to cross-utilize and retrain staff to increase their productivity. These actions will allow the redeployment of some positions in FY 2014 to offset increases in other high priority activities.

Financial and risk surveillance

Staff conducts risk and financial surveillance of DCOs, clearing FCMs, and other market participants such as swap dealers, major swap participants, and large traders that may pose a risk to the clearing process.

Financial and risk surveillance technology allows staff to identify large traders whose positions may pose financial risk to the industry or a clearing firm, analyze an owner's holdings and project the effect of market moves on these holdings, perform "what if" stress testing and risk scenarios to determine the effect of market movement on margin, and evaluate overall portfolio risk under different market conditions. Financial and risk surveillance technology also allows staff to monitor FCMs by storing and analyzing monthly financial statements and annual reports provided to the Commission to report net capital positions and other financial information. The Commission's current financial and risk surveillance technology has been primarily applied to futures and options on futures products. Following the collection of position data on cleared swaps and over-the-counter products, the Commission will update existing and introduce new financial and risk surveillance technology to expand data intake, surveillance, analysis, and reporting.

Business analytics

CFTC also maintains a business analytics platform for performing data analysis. The platform allows staff analyzing industry data to keep pace with the continuing growth in industry data volume and complexity. The Commission will improve its ability to conduct surveillance, investigations, and economic analysis by providing additional data partitioning, parallel processing, high-performance indexing, and query optimization. These improvements will allow staff to more quickly gather subsets of enterprise data for analysis, optimize the analytics performance, and reduce extraction, transformation and loading times for very large order message volumes, market reconstructions and simulation, complex swap valuation, and high frequency and algorithmic datasets.

Summary

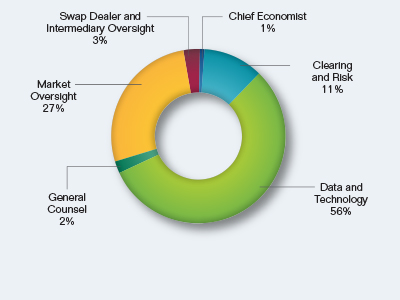

Organizationally, the Commission's increases related to surveillance, including data acquisition and analytics will support the requirements of six Divisions:

| FTE | Salaries and Expenses | IT | Total | |

|---|---|---|---|---|

| Chief Economist | 2 | $480 | $0 | $480 |

| Clearing and Risk | 28 | 6,680 | 0 | 6,680 |

| Data and Technology | 60 | 14,310 | 20,280 | 34,590 |

| General Counsel | 4 | 950 | 0 | 950 |

| Market Oversight | 71 | 16,920 | 0 | 16,920 |

| Swap Dealer and Intermediary Oversight | 9 | 2,150 | 0 | 2,150 |

| Total | 174 | $41,490 | $20,280 | $61,770 |

Surveillance, including Data Acquisition and Analytics Request by Division