CFTC Mission

To protect market users and the public from fraud, manipulation, abusive practices and systemic risk related to derivatives that are subject to the Commodity Exchange Act,

and to foster open, competitive, and financially sound markets.

A Message from

the Chairman

I am pleased to present the Fiscal Year 2014 Annual Performance Report and Fiscal Year 2016 Annual Performance Plan for the Commodity Futures Trading Commission (CFTC). Together, these reports document the progress we have made over the last fiscal year, and lay out our goals for the year ahead.

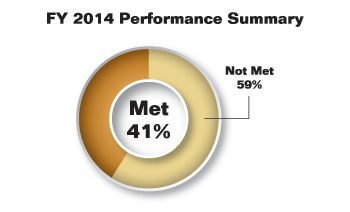

The Fiscal Year (FY) 2014 Annual Performance Review Report (APR) tracks the CFTC’s performance against the goals included in the Commission’s Strategic Plan FY 2011–2015. These goals were developed following passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), which expanded the CFTC’s responsibilities to include regulation and oversight of the swaps market. In FY 2014, the CFTC met 41 percent of its metrics, roughly in line with the results in the prior year.

Over the past year, implementation of the new framework to bring the over-the-counter (OTC) swaps market out of the shadows has continued to be a significant priority. As we have increased the percentage of OTC swaps that are centrally cleared, we have also been working to make sure that clearinghouses have the resources and necessary safeguards to operate in a fair, transparent, and efficient manner. Another priority has been to fine-tune our rules so that we make sure commercial end-users can continue to use these markets effectively and efficiently. The Commission took a number of steps in this regard, including actions to exempt end-users from requirements to post margin, addressing end-user concerns regarding the posting of collateral, reducing reporting and recordkeeping requirements in certain areas, and clarifying the treatment of forward contracts. Enforcement has also continued to be a key priority, as a robust compliance and enforcement program is crucial to maintaining the integrity of our markets, as well as public confidence. We have pursued several significant enforcement matters, ranging from traditional Ponzi schemes and precious metal scams that target retirees, to complex manipulation schemes driven by sophisticated, electronic trading strategies, to price fixing or benchmark manipulation through collusion among some of the world’s largest banks.

While we made progress in many areas during FY 2014, as the APR documents, we did not meet performance targets in many areas. One significant reason is our budget. We have a dedicated staff who work very hard, but our resources are often stretched too thinly. For example, because of resource constraints, we did not meet performance targets for risk-based examinations entities that we oversee, including clearinghouses, exchanges, and swap dealers. We will continue to do all we can with the resources we have, but the fact is that budget constraints have impaired our ability to meet our targets in key areas of our responsibility.

The futures, options, and swaps markets that the CFTC oversees are critical to our economy. They enable businesses of all types to manage risk, and these markets profoundly affect the prices we all pay for food, energy, and most other goods and services we buy each day. In normal times, these markets create substantial, but largely unseen, benefits for American families. During the 2008 financial crisis, however, they created just the opposite. The build-up of excessive risk accelerated and greatly intensified the crisis, which was the worst since the Great Depression—millions of jobs lost and homes foreclosed, countless retirements and educations deferred, and businesses shuttered.

This is why the work of the CFTC is so important. We must make sure that farmers, ranchers, manufacturers, and other companies can continue to use these markets effectively to manage risk. And we must do all we can to make sure that the type of excessive risks related to derivatives that contributed to the financial crisis do not happen again.

Over the last several years, the derivatives markets have grown substantially in scale, technological sophistication, and complexity. The number of actively traded futures and options contracts, for example, has doubled since 2010. Derivatives trading is increasingly conducted in an automated, electronic fashion.

For the derivatives markets to work well for the businesses that need them, a framework of sensible oversight that promotes market integrity and transparency, as well as competition and innovation, is vital. To conduct surveillance of today’s markets requires very sophisticated technological capabilities, as well as highly-skilled professionals who can monitor, analyze, and interpret vast amounts of data. Cybersecurity is another area that is of ever-increasing importance. Cyberattacks are more frequent and sophisticated than ever before. They represent a significant risk to financial stability. We must do all we can to enhance readiness, including more frequent and robust examinations of clearinghouses, exchanges, and market participants. Likewise in the area of enforcement, the expansion and evolution of the markets we oversee has been a challenge. We have brought many important enforcement actions, and collected fines and penalties between FY 2009 and FY 2014 that were twice our cumulative budgets, which monies go to the U.S. Department of the Treasury and do not fund our budget. Indeed, in the first four months of FY 2015, fines and penalties collected were six times our budget. But for every case we bring, there are many more leads we would like to pursue.

The CFTC’s capabilities and resources must match the scale and sophistication of the derivatives markets today. That means making sure that we are making smart investments and focusing our resources to be as effective as possible. To that end, last year, the Commission developed a new strategic plan that reflects the CFTC’s broadened responsibilities and market developments.

The new FY 2014–2018 CFTC Strategic Plan, which the Commission approved in October 2014, sets out an updated set of performance measures, designed to drive excellence, promote efficiency, and help us execute on our mission. The Commission will use the strategic plan to measure its progress going forward. As part of the new strategic plan, we also developed an Information Technology Strategic Plan, which provides direction for how technology will support our expanded mission, and improve efficiency and effectiveness. Corresponding to the new strategic plan, the second portion of this report is the FY 2016 Annual Performance Plan (APP), which sets forth our goals and priorities. Going forward, the CFTC will publish this report to set out our strategic goals and our progress in accomplishing them.

We will focus our efforts on four broad goals: market integrity and transparency, financial integrity and avoidance of systemic risk, comprehensive enforcement, and domestic and international cooperation and coordination. Each of these goals cuts across the Commission’s operational groups, and each is vital to fulfilling our mission. As described in the APP, these goals will help us fulfill our mission to foster open, transparent, competitive, and financially sound derivatives markets, to mitigate systemic risk, and to protect market participants and the public from fraud, manipulation, and abuse.

In addition, the APP includes specific management goals designed to make sure the CFTC can attract and maintain a workforce capable of carrying out our mission and that the Commission is a prudent steward of public funds.

The United States has had the best derivatives markets in the world for decades—the largest, most dynamic, and most innovative. They have served the needs of farmers, ranchers, manufacturers, and other businesses well. The strength of our markets is due in part to the fact that we have maintained a sensible regulatory framework that has helped to insure integrity and transparency and attracted market participants from around the world. With an appropriate level of resources and sensible oversight, our derivatives markets can continue to be second to none.

![]()

Timothy G. Massad

February 25, 2015

Overview

Overview presents key information regarding the CFTC FY 2014 Annual Performance Report. See below for details on the various sections.

-

Introduction

This document presents the CFTC Annual Performance Report (APR) for Fiscal Year 2014 and the Annual Performance Plan (APP) for Fiscal Year 2016. It is prepared in accordance with the requirements of the Government Performance and Results Act (GPRA) Modernization Act of 2010 (GPRAMA) and Office of Management and Budget (OMB) Circular A-11 Part 6. This report includes performance measure analysis and review of each of the five strategic goals and the tactical goal for Dodd-Frank Act rulemaking.

History

Congress established the CFTC as an independent agency in 1974, after its predecessor operated within the U.S. Department of Agriculture. Its mandate was renewed and/or expanded in 1978, 1982, 1986, 1992, 1995, 2000, 2008, and 2010. The CFTC and its predecessor agencies were established to protect market participants and the public from fraud, manipulation, and other abusive practices in the commodity futures and options markets. After the 2008 financial crises and the subsequent enactment of the Dodd-Frank Act, the CFTC’s mission expanded to include oversight of the swaps marketplace.

The Commission administers the Commodity Exchange Act (CEA), 7 U.S.C. section 1, et seq. The CEA brought under Federal regulation futures trading in all goods, articles, services, rights, and interests; commodity options trading; and leverage trading in gold and silver bullion and coins; and otherwise strengthened the regulation of the commodity futures trading industry. It established a comprehensive regulatory structure to oversee the volatile futures trading complex.

On July 21, 2010, President Obama signed the Dodd-Frank Act, which amended the CEA to establish a comprehensive new regulatory framework for swaps, as well as enhanced authorities over historically regulated entities. Title VII of the Dodd-Frank Act, which relates to swaps, was enacted to reduce systemic risk, increase transparency, and promote market integrity within the financial system.

The U.S. futures and swaps markets are estimated at $30 trillion and $400 trillion, respectively. By any measure, the markets under CFTC’s regulatory purview are large and economically significant. Given the enormity of these markets and the critical role they play in facilitating price discovery and hedging of risk, ensuring that these markets are transparent, open, and competitive is essential to their proper functioning and to help safeguard the financial stability of the Nation.

In February 2011, the Commission published a new strategic plan, CFTC FY 2011–2015 Strategic Plan (http://www.cftc.gov/reports/strategicplan/2015/index.htm), integrating the expanded responsibilities under the Dodd-Frank Act with its existing mission and goals. The regulation of swaps has been incorporated into the regulatory structure that has existed for futures and options markets. The CFTC has been working to write the rules Congress mandated to regulate the swaps markets, implement those rules, test and adjust those rules, and write new rules as necessary to bring effective regulation to all derivatives markets over the five-year period.

The focused rule-writing effort to complete the remaining 6 rules required by the Dodd-Frank Act remains a tactical goal that has an objective, strategy, and performance measure associated with it. Developing and implementing the Dodd-Frank Act rules is one of the most important and difficult efforts the Commission has ever undertaken. The Dodd-Frank Act set a timeframe of 360 days (or less in a few instances) for completion of the rules, but the Commission was unable to comply with this for several reasons:

- Commission’s continued budget constraints;

- Commitment to significant and open interaction with Congress; market participants; the public; and other regulators, both domestic and international; and

- Expanded rule complexity.

The comment and consideration aspects of the rulemaking process take an enormous amount of time. The Commission has and will continue to ensure all appropriate thought is given to rule development.

The Commission is committed to transparency in the rulemaking process. As such, the Commission maintains a list of all of its meetings relating to the implementation of the Dodd-Frank Act, as well as the participants, issues discussed, and all materials provided to the Commission, on its website at http://www.cftc.gov/LawRegulation/DoddFrankAct/ExternalMeetings/index.htm.

-

About This Report

The FY 2014 APR and FY 2016 APP provides an overview of the CFTC’s performance results relative to its mission in order to help Congress, the President, and the public assess the CFTC’s stewardship over the financial resources entrusted to it. The report is organized by strategic goal and performance measure, and provides detail on how each contributes to the Commission’s overall mission. The report provides information about the Commission’s performance as an organization, its achievements, and its challenges.

The APR/APP meets a variety of reporting requirements stemming from numerous laws focusing on improved accountability among Federal agencies and guidance described in OMB Circulars A-11 and A-136.

Suggestions for improving this document can be sent to the following address:

Commodity Futures Trading Commission

Business Management and Planning Branch

Three Lafayette Centre

1155 21st Street, NW

Washington, DC 20581The Commission’s annual reporting includes the following four components described to the right. When complete, these reports are available on the Commission’s website at

http://www.cftc.gov/About/CFTCReports/index.htm.Agency Financial Report (AFR)

Available December 2014. The AFR is a report on the Commission end of year financial position that includes, but is not limited to, financial statements, notes to the financial statements, and a report of the independent auditors.

Annual Performance Report (APR)

Available February 2015. The APR is a report on the Commission’s performance that is available to Congress with the Congressional Budget Justification in February. The APR contains information on the CFTC’s progress to achieve goals during the previous year.

Annual Performance Plan (APP)

Available February 2015. Under the GPRAMA, an agency’s APP defines the level of performance to be achieved during the year in which the plan is submitted and the next fiscal year. The APP may be used to structure the Commission’s budget submission or be a separate document that accompanies the CFTC’s budget submission. An APP must cover each program activity of the Commission set forth in the budget.

Summary of Performance and

Financial Information (SPFI)Available February 2015. This document provides an integrated overview of performance and financial information that integrates significant aspects of the AFR and the APR into a user-friendly consolidated format.

-

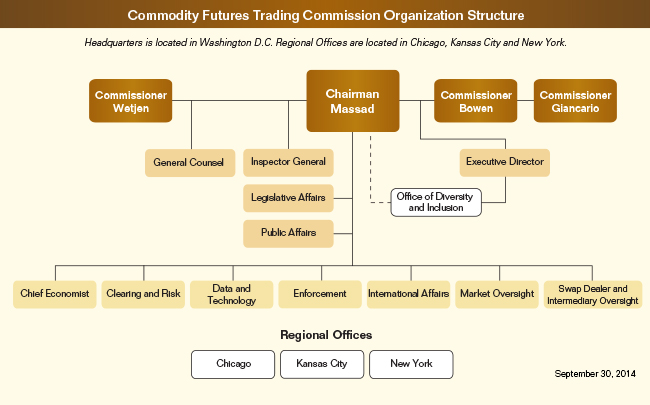

The Organization

-

CFTC Organizational Programs

Below are brief descriptions of the organizational programs within the CFTC.

The Commission

The Offices of the Chairman and the Commissioners provide executive direction and leadership to the Commission. The Offices of the Chairman include Public Affairs and Legislative Affairs.

Division of Clearing and Risk (DCR)

The DCR program supervises the derivatives clearing organizations (DCOs) that clear futures, options on futures, and swaps, which involves supervision of DCOs and surveillance of other market participants that may pose risk to the clearing process, including futures commission merchants (FCMs), swap dealers (SDs), major swap participants (MSPs), and large traders. The DCR staff: 1) prepare proposed and final regulations, orders, guidelines, exemptions, interpretations, and other regulatory work products on issues pertaining to DCOs and, as relevant, other market participants; 2) review DCO applications and rule submissions and make recommendations to the Commission; 3) make recommendations to the Commission as to categories of swaps that should be subject to mandatory clearing determinations; 4) make recommendations to the Commission as to the initial eligibility or continuing qualification of a DCO to clear swaps; 5) assess compliance by DCOs with the CEA and Commission regulations, including examining systemically important DCOs (SIDCOs) at least once a year; 6) conduct risk assessment and financial surveillance through the use of risk assessment tools, including automated systems to gather and analyze financial information, and identify, quantify, and monitor the risks posed by DCOs, clearing members, and market participants and their financial impact; 7) evaluate new DCO margin models and enhancements to existing margin models; 8) review DCO notifications regarding systems disruptions, material planned changes to mission critical systems or programs of risk analysis and any other notifications that potentially impact the DCO’s ability to process, clear, and risk manage its business activities; 9) work with staff of the Board of Governors of the Federal Reserve, the U.S. Securities and Exchange Commission (SEC), and other financial regulatory agencies to analyze risk issues related to central counterparty (CCP) clearing; and 10) working with the Office of International Affairs (OIA), participate in the work of international regulators in setting worldwide standards with respect to CCPs and their members, and in evaluating the application of those standards.

Division of Enforcement (DOE)

The DOE program investigates and prosecutes alleged violations of the CEA, the Dodd-Frank Act, and Commission regulations. Possible violations include manipulation, disruptive trading, fraud, capitalization and segregation deficiencies, supervisory violations, and other abuses concerning derivatives that are traded on U.S. exchanges, and threaten market integrity, market participants, and the general public. The Whistleblower Office (WBO), a component of the DOE, performs the ministerial functions and determination of preliminary award eligibility, and guides the anti-retaliation protections of whistleblower matters as needed during examination, investigation, and litigation.

Division of Market Oversight (DMO)

The DMO program fosters markets that accurately reflect the forces of supply and demand for the underlying commodities and are free of disruptive activity. To achieve this goal, program staff oversee trade execution facilities, perform market and trade practice surveillance, review new exchange applications, and examine existing exchanges to determine their compliance with the applicable core principles. Other important work includes evaluating new products to make certain that they are not susceptible to manipulation, and reviewing exchange rules and actions to ensure compliance with the CEA and CFTC regulations.

Division of Swap Dealer and Intermediary Oversight (DSIO)

The DSIO program oversees the registration and compliance activities of intermediaries and the futures industry self-regulatory organizations (SROs), which include the U.S. derivatives exchanges and the National Futures Association (NFA). Program staff develop and implement regulations concerning registration, fitness, financial adequacy, sales practices, protection of customer funds, crossborder transactions, and anti-money laundering programs, as well as policies for coordination with foreign market authorities and emergency procedures to address market-related events that impact intermediaries. The DSIO monitors the compliance activities of these registrants and provides oversight and guidance for complying with the system of registration and compliance established by the CEA and Commission’s regulations. Concurrently, the DSIO evaluates the effectiveness of registrant governance and internal oversight through targeted reviews and examinations, oversight of examinations performed by SROs, and a focus on the activities of the risk managers and chief compliance officers. The DSIO also reviews whether registrants maintain sufficient financial resources, risk management procedures, internal controls, and customer protection practices to enhance the financial stability of market participants and transparency in the markets.

Office of the Chief Economist (OCE)

The OCE provides economic analysis and advice to the Commission, conducts research and provides advice on policy issues facing the Commission, and educates and trains Commission staff. The OCE plays an integral role in the development and implementation of Commission regulations by providing economic expertise and considering the costs and benefits of these regulations. The OCE also plays a key analytical role in the Commission’s efforts to leverage the enhanced data available under the new regulatory framework.

Office of Data and Technology (ODT)

The ODT is led by the Chief Information Officer and delivers services to CFTC through three components: systems and services, data management, and infrastructure and operations. Systems and services focuses on several areas: market and financial oversight and surveillance; enforcement and legal support; document, records, and knowledge management; CFTC-wide enterprise services; and management and administration. Systems and services provides access to data and information, platforms for data analysis, and enterprise-focused automation services. Data management focuses on data analysis activities that support data acquisition, utilization, management, reuse, transparency reporting, and data operations support. Data management provides a standards-based, flexible data architecture; guidance to the industry on data reporting and recordkeeping; reference data that is correct; and market data that can be efficiently aggregated and correlated by staff. Infrastructure and operations organizes delivery of services around network infrastructure and operations, telecommunications, and desktop and customer services. Delivered services are widely available, flexible, reliable, and scalable, supporting the systems and platforms that empower staff to fulfill the CFTC mission. The three service delivery components are unified by an enterprise-wide approach that is driven by the Commission’s strategic goals and objectives and incorporates information security, enterprise architecture, and project management.

Office of the General Counsel (OGC)

The OGC provides legal services and support to the Commission and all of its programs. These activities primarily include: 1) providing advice on complex questions of statutory and regulatory interpretation arising under the CEA; 2) representing the Commission in U.S. Courts of Appeals, amicus curiae litigation, industry bankruptcies, defense of rule challenges, and other litigation; 3) providing legal support and advice in connection with other relevant Federal statutes; 4) assisting the Commission in the performance of its adjudicatory functions; and 5) providing advice on legislative and other intergovernmental issues.

Office of International Affairs (OIA)

The OIA advises the Commission regarding international regulatory initiatives; provides guidance regarding international issues raised in Commission matters; represents the Commission in international organizations, such as the International Organization of Securities Commissions (IOSCO); coordinates Commission policy as it relates to policies and initiatives of major international jurisdictions, the G-20, the Financial Stability Board (FSB), and the U.S. Department of the Treasury (Treasury); and provides technical assistance to international market authorities.

Office of the Inspector General (OIG)

The OIG is an independent organizational unit at the CFTC. The mission of the OIG is to detect waste, fraud, and abuse and to promote integrity, economy, efficiency, and effectiveness in the CFTC’s programs and operations. As such it has the ability to review all of the Commission’s programs, activities, and records. In accordance with the Inspector General Act of 1978, as amended, the OIG issues semiannual reports detailing its activities, findings, and recommendations.

Office of the Executive Director (OED)

The Commission’s ability to achieve its mission of protecting the public, derivative market participants, U.S. economy, and the U.S. position in global markets is driven by well-informed and reasoned executive direction; strong and focused management; and an efficiently-resourced, dedicated, and productive workforce. These attributes of an effective organization combine to lead and support the critical work of the Commission to provide sound regulatory oversight and enforcement programs for the U.S. public. The Executive Director ensures the Commission’s continued success, continuity of operations, and adaptation to the ever-changing markets it is charged with regulating; directs the effective and efficient allocation of CFTC resources; develops and implements management and administrative policy; and ensures program performance is measured and tracked Commission-wide. The OED includes the following programs: Business Management and Planning, Consumer Outreach, Executive Secretariat, Financial Management, and Human Resources.

-

Strategic Framework

The following table is an overview of the Commission’s mission statement, strategic goals and objectives under the FY 2011–2015 strategic framework:

Mission Statement

To protect market users and the public from fraud, manipulation, abusive practices and systemic risk related to derivatives that are subject to the Commodity Exchange Act, and to foster open, competitive, and financially sound markets.Strategic Goal One

Protect the public and market participants by ensuring market integrity, promoting transparency,

competition and fairness and lowering risk in the system.Objectives - Ensure that markets are structured to reflect the forces of supply and demand for the underlying commodity and are free from manipulation, disruptive activity and abusive trading practices.

- Ensure that U.S. DCMs and SEFs have the systems, procedures and resources necessary for effective self-regulation and ongoing compliance with core principles.

- Promote transparency by producing and publishing summary market statistics for the futures, options and swaps markets.

Strategic Goal Two

Protect the public and market participants by ensuring the financial integrity of derivatives transactions,

mitigation of systemic risk, and the fitness and soundness of intermediaries and other registrants.Objectives - Clearing organizations and firms participating in the derivatives industry are financially sound.

- Registered intermediaries meet standards for fitness and conduct.

- Ensure that self-regulatory organizations fulfill their financial surveillance responsibilities.

- Ensure that information technology systems support the Commission’s existing and expanded responsibilities to ensure financially sound markets, mitigate systemic risk, and monitor intermediaries

Strategic Goal Three

Protect the public and market participants through a robust enforcement program.

Objectives - Identify and stop violations of the Commodity Exchange Act and Regulations; deter others from engaging in future misconduct.

- Increase cooperative enforcement.

Strategic Goal Four

Enhance integrity of U.S. markets by engaging in cross-border cooperation, promoting strong international regulatory standards, and encouraging ongoing convergence of laws and regulation worldwide.

Objectives - Cooperate and coordinate with domestic and foreign regulatory authorities.

- Promote high levels of internationally accepted standards of best practice.

- Provide global technical assistance.

Strategic Goal Five

Promote Commission excellence through executive direction and leadership, organizational and individual performance management, and effective management of resources.

Objectives - An organizational structure that is aligned and streamlined to operate and carry out its mission efficiently and effectively.

- Effectively respond to the regulatory needs of a dynamic and complex derivatives market place and efficiently allocate limited resources to the highest priority activities

- Attract, engage, develop and retain an exceptionally qualified, diverse, and productive workforce.

- Information technology supports and enhances mission accomplishment through effective and efficient infrastructure, systems and services.

- Ensure effective stewardship and management of CFTC financial resources.

-

Summary of Performance

The following sections include a high-level discussion of each of the five strategic goals and the tactical goals for Dodd-Frank Act rulemaking, as well as a detailed analysis and review of each performance measure (shortfalls and successes). The accomplishments demonstrate progress made in FY 2014 toward the achievement of the Commission’s mission and strategic goals. However, in many areas progress was limited by resource constraints and reallocations in an attempt to maintain progress toward writing and implementing the new rules required under the Dodd-Frank Act. The Commission’s regulatory purview has expanded in scope, scale and complexity with the passage of the Dodd-Frank Act and the increased use of technology in the markets in the last five years. However, the Commission was not provided with the commensurate increase in budget authority to oversee the markets and market participants over that period of time. These constraints have limited the effectiveness of the Commission in carrying out its mission.

In FY 2015, the Commission will begin monitoring and analyzing strategic objectives outlined in the new Strategic Plan which spans FY 2014 to FY 2018. This new strategic plan will have a different set of performance goals across the Commission, many of which are new goals. The CFTC plans to monitor these goals on a quarterly basis, provide better and more frequent assessments to leadership, and provide division and office directors more time to make adjustments where warranted.

Some performance measures described in the current FY 2011 to FY 2015 Strategic Plan are dependent upon the completion of specific rules or remained in development from the onset of the Strategic Plan. As a result, five of the 54 performance measures were considered “Not Applicable” during the FY 2014 reporting period.

The following identifies the specific performance measures considered “Not Applicable”:

- 1.1.1.2 Implement automated surveillance alerts and a case management system.

- 1.1.2.1 Review information requirements of current and proposed forms.

- 1.1.3.1 Transmit information and consult with the Office of Information Technology Services (OITS) [Now recognized as the Office of Data and Technology—ODT] to implement electronic filing of forms. Fully deploy electronic filing of trader reporting forms.

- 3.1.1.2 The CFTC will bring claims in due recognition of the broadened enforcement mandate provided by the Dodd-Frank Act, and will seek proportionate remedies, including civil monetary penalties, undertakings and restitution, that have the highest impact on and greatest deterrent effect against potential future violations.

- 4.1.1.2 Regular issuance of outgoing international requests for enforcement assistance and referrals made by the CFTC to foreign regulators pertaining to matters involving their jurisdictions.

The following performance measures have been completed:

- 5.1.1.1 Executive approval and Commission adoption of efficient and effective organizational design.

- 5.3.1.1 Assess, develop, and implement automated hiring system.

- 5.3.3.1 Develop and implement comprehensive development and education program.

- 5.5.2.1 Management control reviews are conducted and documented. Recommendations are implemented. The Chairman and the Chief Financial Officer (CFO) are able to give unqualified Federal Managers’ Financial Integrity Act (FMFIA) management assurances.

- 5.5.3.1 Implement web-based time and attendance system.

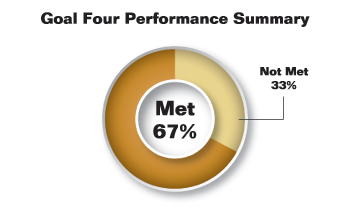

The performance measures in this report are rated as: Met, or Not Met. Overall results for the Commission’s performance measures are depicted in the following table:

CFTC Performance Results # of Measures1 Met Not Met All Goals 44 18 26 % of Total 41% 59% 1 Excludes five performance measures categorized as “Not Applicable” and five performance measures that were completed prior to FY 2014. (back to text) -

Looking Ahead

A new Strategic Plan spanning FY2014 to FY 2018 will be introduced starting in the next FY 2015 performance cycle. The new Strategic Plan will monitor a new set of performance goals (previously performance measures).

In building the new FY 2014–2018 Strategic Plan, the CFTC evaluated the effectiveness and usefulness of previous measures in conveying program success. While the Commission believes that in aggregate, they provide an accurate portrayal of progress, the Commission saw the opportunity to improve in a couple of key areas. First, performance goals are most useful when each division or office director is held accountable for these goals and strategies. Updating the goals twice a year meant that directors had little or no time to make course corrections if their programs were underperforming. Second, with the administration-wide push to develop outcome based measures, the CFTC had the opportunity to revise several output based measures to make them more informative. Finally, the Commission tied the performance goals to the broader strategic goals and objectives instead of individual strategies, which should be a better gauge of program success.

A top down approach was used to build the FY 2014 to FY 2018 performance goals. The first priority was to analyze each strategic goal and strategic objective to isolate key variables that indicate whether progress is being made. This is an especially difficult task as many of the goals and objectives are abstract in nature (e.g., measuring the susceptibility of markets to manipulation and other abusive practices). Accordingly, the CFTC developed multiple performance goals per strategic goal and in some cases per strategic objective. When viewed together, the Commission believes they will display whether true progress is being made towards the goal.

The result is 38 performance goals across the Commission, many of which are new goals. In FY 2014 and FY 2015, these will be baselined with targets established in the APP. The CFTC plans to monitor these goals on a quarterly basis, provide better and more frequent assessments of accomplishments to leadership, and provide division and office directors more time to make adjustments where warranted.

The CFTC will seek greater accountability by developing annual operational plans. These operational plans tie the strategic goals and objectives with tactical requirements. The goals, objectives, and strategies will also be included in the annual performance evaluations of the office or division director or particular staff charged with implementing the goals, objectives, and strategies.

Performance Analysis

and Review

Performance Analysis and Review presents an overview as well as details for Objective 0.1 and the five Strategic Goals. See below for information on each goal including introduction, performance measures, performance results, and performance analysis and review.

-

-

Overview

The remaining portion of this report details the Commission’s efforts to meet its rulemaking objectives, strategic goals, and performance targets as described in the Strategic Plan. Each strategic goal is summarized with high-level achievements before leading into a detailed performance analysis and review narrative for each associated measure. For reference purposes, each performance measure is uniquely identified using the following hierarchical structure:

Strategic Goal.Objective.Strategy.Performance Measure (e.g., 1.1.1.1)

Appendix B, “CFTC Performance Measures and Results,” provides a summary of performance measure information in table format for FY 2011 and 2012 Actual; FY 2013 Actual; and FY 2014 Planned and Actual. Performance measures which were rule-dependent (Dodd-Frank Act) and/or others considered “Not Applicable” during FY 2014 have been listed after the table in a section titled “Performance Measures Considered Not Applicable in FY 2014.”

-

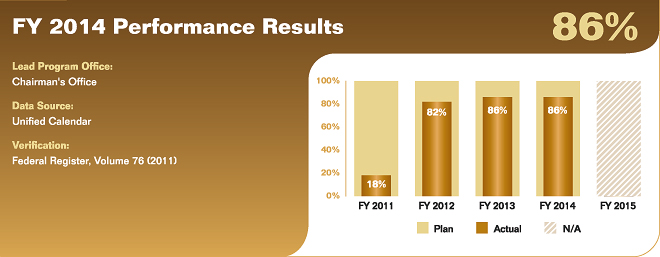

Objective 0.1—Complete all Dodd-Frank Act rule development requirements within the statutory deadlines.

PERFORMANCE MEASURE 0.1.1.1 Complete all Dodd-Frank Act rules within statutory time frames. Percentage of rules complete.

FY 2014 Target: 100%

Performance Analysis & Review

The performance target was not met for FY 2014. The Dodd-Frank Act set a timeframe of 360 days (or less in a few instances) for completion of the rules. The Commission has been unable to accomplish this for several reasons. Primarily, the continued delay is a matter of capacity for rule consideration. With all rules, the CFTC has taken, and will continue to take, a thoughtful and balanced approach. The Commission actively seeks and takes into full consideration public comments regarding the costs, benefits, and economic effects of proposed rules. Given the significance of the rules and consequent public interest, it has taken substantial time and resources to accomplish this. Several other variables contributed to the delay.

- To ensure development and implementation of rules that are well balanced between risk mitigation and cost to the industry and public, additional meetings and opportunities for public input with Congress, industry, and the public were necessary and appropriate; and

- While some rules are fairly straight forward, many are intricate and raise interrelated and complex issues. Staff members require the appropriate time to analyze, summarize, and consider the additional public input that has been sought, and develop draft final rules for deliberation by the Commission.

Despite the above limitations placed on the Commission since the onset of the massive undertaking, it was able to accomplish the following Dodd-Frank Act related rulemaking tasks through September 30, 2014:

- Issued 74 proposed rules and issued 64 final rules;

- Received, reviewed, and analyzed approximately 36,000 comments; and

- Held 16 technical conferences/roundtables.

Remaining rules to be finalized by the Commission as mandated by the Dodd-Frank Act are as follows:

- Capital Requirements for Swap Dealers and Major Swap Participants (76 FR 27802);

- Margin Requirements for Uncleared Swaps for Swap Dealers and Major Swap Participants (79 FR 59898);

- Governance Requirements for Designated Contract Markets and Swap Execution Facilities; Additional Requirements Regarding the Mitigation of Conflicts of Interest (76 FR 722);

- Requirements for Designated Contract Markets and Swap Execution Facilities Regarding the Mitigation of Conflicts of Interest (75 FR 63732);

- Position Limits for Commodity Derivatives Contracts (78 FR 75680); and

- Annual Stress Test (§ 165(i); this rule has not been proposed).

-

-

-

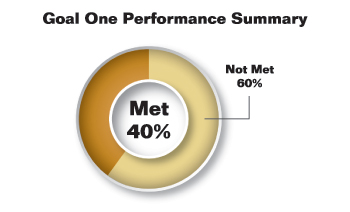

Goal One—Protect the public and market participants by ensuring market integrity, promoting transparency, competition and fairness and lowering risk in the system.

Derivatives markets are designed to provide a means for market users to offset price risks inherent in their businesses and to act as a public price discovery platform from which prices are broadly disseminated for public use. For derivatives markets to fulfill their role in the national and global economy, they must operate efficiently and fairly, and serve the needs of market users. The markets best fulfill this role when they are open, competitive, and free from fraud, manipulation, and other abuses such that the prices discovered on the markets reflect the forces of supply and demand.

The Commission strives to assure that Goal One is effectively met through the combined use of four oversight strategies: 1) review of new contracts and rules, and amendments to existing contracts and rules; 2) surveillance of trading activity in the futures and swaps markets; 3) review of regulated exchanges, designated contract markets (DCMs), Swap Execution Facilities (SEFs) and swap data repositories (SDRs) to verify whether they are fulfilling their self-regulatory obligations; and 4) adoption of policies and strategies to promote market transparency.

Accomplishments related to progress in achieving this goal include:

- Completed and began implementing the rules providing registration and operation requirements for SEFs that became effective on May 16, 2013, and provisionally registered 22 SEFs by May 9, 2014.

- Completed three rule enforcement reviews (RERs) of DCMs. These include RERs of the North American Derivatives Exchange (NADEX) in November 2013, OneChicago in April 2014, and ICE Futures U.S. in July 2014.

- Completed reviews of 80 new product certifications, nine exempt market filings, 932 rule filings, 24 foreign security index certifications, and one Foreign Board of Trade no action request. Completed reviews of all SDR applications for provisional registration.

- Issued an amendment to 17 CFR §49.17(f)(2) adopting an interim final rule to clarify the scope of permissible access by market participants to swap data and information maintained by a registered SDR. This rule provides an exception for data and information related to a particular swap that is maintained by the registered SDR to be accessible by either counterparty to that particular swap.

- Continued its efforts to monitor futures commission merchants (FCMs) by conducting various direct and horizontal limited scope reviews while reviewing over 1,200 financial filings and 1,700 notices. The new horizontal reviews focused on the liquidity of FCMs, the sufficiency of excess segregation and secured requirements, risk management, and internal controls at FCMs. With the assistance of the designated self-regulatory organizations (DSROs), the Commission also successfully managed the wind down and transfer customer accounts of four FCMs in financial distress.

- Streamlined and completed approximately half of its sampling review work in connection with the process of registering two new categories of registrants—swap dealers (SDs) and major swap participants (MSPs). The CFTC provided extensive interpretive guidance to NFA in its front line registration activities.

- Finalized the Volcker Rule with the Federal Reserve Board, Office of the Comptroller of the Currency, Federal Deposit Insurance Corporations, and SEC, and coordinated with those agencies in responding to numerous frequently asked questions and interpretive inquiries. The CFTC also developed the database systems and worked with the other agencies and banking entities to prepare for and begin receiving the required Volcker reporting metrics data in a standardized format.

- Continued the use of Special Call Authorities, which require entities to provide data and market behavior explanations not normally available to the CFTC, in conjunction with data already within or available to the Commission to detect compliance violations and manipulation for further referral for investigation to the DOE.

- Completed the “Made Available to Trade” rulemaking, effective on May 16, 2013, that allows a DCM or SEF to subject a swap that it determines is “available to trade” to the trade execution requirement.

- Drafted two significant IOSCO reports: the report on over-the-counter (OTC) derivatives data reporting and aggregation requirements, and the report on trading of OTC derivatives.

- Created three new automated alerts and three new reports and enhanced four trade practice alerts, providing for a more efficient and effective market and trade surveillance program.

Goal One performance measure results are depicted in the following table:

Goal One Performance Results # of Measures2 Met Not Met Goal One 10 4 6 % of Total 40% 60% 2 Excludes three performance measures categorized as “Not Applicable” for FY 2014. (back to text) -

Goal One performance measures, analysis and review – Objective 1.1

PERFORMANCE MEASURE 1.1.1.1 Implement automated position limit alerts for futures, option, and swaps markets.

FY 2014 Target: Implement automated position limit monitoring for all commodities under CFTC position limits using integrated data from reporting firms and swaps data repositories.

Performance Analysis & Review

The performance target was met for FY 2014. The Commission is working to design a system for detecting speculative position limit violations under Commission Regulation 150.2. The remaining part of the build-out is to write the code that will account for hedge exemptions enumerated under Commission Regulations 1.3(z), 1.47, and 1.48.

PERFORMANCE MEASURE 1.1.1.3 Implement automated trading violation alerts and a case management system.

FY 2014 Target: Implement two automated trading violation alerts.

Performance Analysis & Review

The performance target was met for FY 2014. Staff finished and implemented an Exchange of Futures for Related Products (EFRP) In & Out Engine as well as a Relational Trade Engine that finds Exchanges of Futures for Futures. Staff also created code designed to generally detect EFRPs and allow staff to conduct further review of those transactions.

PERFORMANCE MEASURE 1.1.4.1 Percentage of contracts that are reviewed, in a timely manner, following a finding of market significance, and determined to be in compliance with core principles

or referred back to exchange for modification.

FY 2014 Target: 100%

Performance Analysis & Review

The performance target was met for FY 2014. The Commission conducts an initial cursory review of every new product filed with the Commission to determine whether the product appears to comply with the CEA. Full review of contract filings that appear to comply with the CEA typically is deferred until such time that resources are available for full review. Otherwise, the Commission notifies the submitting exchange if a product filing appears to violate the CEA with a recommendation to withdraw or amend the filing. The absence of a full review could result in trading in contracts that may be readily susceptible to manipulation or that are subject to inappropriate position limits. Trading in such contracts could cause distortions in the prices of the underlying and related commodities and adversely affect hedging by commercial entities.

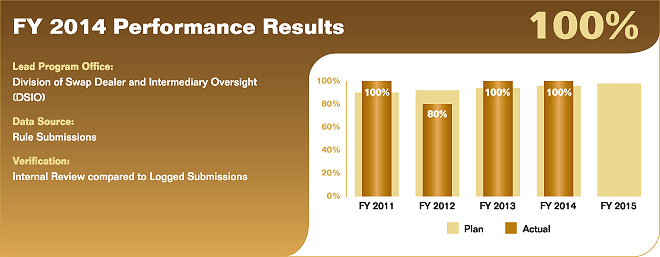

PERFORMANCE MEASURE 1.1.5.1 Rule submissions are reviewed and a determination is made regarding compliance with the CEA, or referred back to the exchange for correction, as amended by the Dodd-Frank Act and Commission regulations within the required 10-day or 90-day time period.

FY 2014 Target: 100%

Performance Analysis & Review

The performance target was met for FY 2014. Product Review Rule Amendments equals 263 submissions reviewed out of 263 submissions received. EDR Rule Amendment Submissions equals 799 submissions reviewed out of 799 submissions received.

PERFORMANCE MEASURE 1.1.6.1 DCM and SEF applications are reviewed and a determination

is made regarding compliance with core principles within statutory time frames.

FY 2014 Target: 100%

Performance Analysis & Review

The performance target was not met for FY 2014. Application reviews are currently in process. As of September 30, 2014, there were three DCM applications pending; one being finalized for review by the Commission, and two other application reviews are stayed pending staff obtaining necessary information from the applicants.

-

Goal One performance measures, analysis and review – Objective 1.2

PERFORMANCE MEASURE 1.2.1.1 Percentage of major DCMs and SEFs reviewed, during the year. (Structural Sufficiency)

FY 2014 Target: 100%

Performance Analysis & Review

The performance target was not met for FY 2014. Examinations staff completed a complex market surveillance RER of ICE Futures U.S. in July 2014. In addition, staff completed three additional RERs of major exchanges in October 2014, just after the end of FY 2014. These RERs include a joint audit trail RER of CME (Chicago Mercantile Exchange) and CBOT (Chicago Board of Trade); a joint trade practice surveillance RER of NYMEX and COMEX; and a joint RER of the disciplinary programs at CME, CBT, NYMEX, and COMEX. Because no SEFs have been permanently registered, there were no RERs of SEFs. In addition to conducting DCM RERs, all Compliance staff devoted a significant amount of time in FY 2014 to reviewing and analyzing SEF applications for full registration and to other DMO projects. Once all SEFs are permanently registered, they will need to be included in the Examinations RER program. Without additional resources, the performance goals for SEFs will not be satisfied. Note: Although CME Group operates four distinct DCMs, for purposes of these performance measures the four DCMs are counted as one because they generally share the same staff, systems, and procedures.

PERFORMANCE MEASURE 1.2.1.2 Percentage of non-major DCMs and SEFs reviewed, during the year. (Structural Sufficiency)

FY 2014 Target: 100%

Performance Analysis & Review

The performance target was not met for FY 2014. Examinations staff completed a RER of the NADEX in November 2013 and a RER of OneChicago Exchange in April 2014. Compliance does not have the necessary resources to meet the target performance standard. However, several of the non-major DCMs have little or no trading volume and do not require annual RERs. As with DCMs, it is likely that SEFs will be divided into major and non-major SEFs. Because SEFs are not permanently registered, the Commission has not initiated RERs for either major or non-major SEFs.

PERFORMANCE MEASURE 1.2.2.1 Percentage of major DCMs and SEFs reviewed, during the year. (Automated Systems and Business Continuity)

FY 2014 Target: 100%

Performance Analysis & Review

The performance target was not met for FY 2014. The Commission has completed a System Safeguards Exam (SSE) for CME Group DCMs. For this performance measure, the four CME Group DCMs are counted as one and not four individual DCMs because CME provides the technology/market continuity related services for all four of the DCMs and there is no distinguishing one among the DCMs in this area. In FY 2014, staff completed all fieldwork and drafted the SSE reports for two additional SSEs, one for CME Group and the other for ICE Futures U.S. However, due to scheduling complications in presenting the examination reports to the Commission for acceptance, both reports will be formally issued in FY 2015.

PERFORMANCE MEASURE 1.2.2.2 Percentage of non-major DCMs and SEFs reviewed, during the year. (Automated Systems and Business Continuity)

FY 2014 Target: 33%

Performance Analysis & Review

The performance target was not met for FY 2014. The Commission has completed an SSE for one of the 11 non-major DCMs (CBOE Futures). The Commission was unable to meet the 33 percent year-end target by doing three additional exams of non-major DCMs due to a severe resource shortage and requirements to review SEF registration applications.

-

Goal One performance measures, analysis and review – Objective 1.3

PERFORMANCE MEASURE 1.3.1.1 Publish reports for swaps markets activity.

FY 2014 Target: Develop and test aggregation methods to group currency, equity, credit and other commodity swap products. Publish swaps market reports for currency, equity, and other commodity swap products. Publish Dodd-Frank Act required semiannual and annual swaps reports for all commodity products under CFTC position limits.

Performance Analysis & Review

The performance target was not met for FY 2014. The Commission has taken all the steps of the development and testing of aggregation methods with respect to the specifically identified categories of swaps conditional on the data supplied to it by the SDRs. There continues to be a high level of dependency on external players delivering clean data to the OCE, delaying the ability to publish semi-annual and annual swaps reports.

Swaps reports are published weekly to CFTC.gov: http://www.cftc.gov/MarketReports/SwapsReports/index.htm.

-

-

-

Goal Two—Protect the public and market participants by ensuring the financial integrity of derivatives transactctions, mitigation of systemic risk, and the fitness and soundness of intermediaries and other registrants.

In fostering financially sound markets, the Commission’s main priorities are to avoid disruptions to the system for clearing and settling contract obligations and to protect the funds that customers entrust to futures commission merchants (FCMs), swap dealers (SDs), commodity pool operators (CPOs), commodity trading advisors (CTAs) and other intermediaries. Effective regulatory oversight of clearing and intermediary entities is integral to the financial integrity of derivatives transactions, and by extension, the faith and confidence of market users. Key aspects of the CFTC’s regulatory framework for achieving Goal Two are requiring that: 1) market participants post margin to secure their ability to fulfill financial obligations; 2) participants on the losing side of trades to meet their obligations, in cash, through daily (sometimes intraday) margin calls; 3) FCMs and other intermediaries to maintain minimum levels of operating capital; and 4) FCMs segregate customer funds from their own funds. Additionally, with respect to CPOs and CTAs, a mechanism for monitoring CPOs and CTAs is the data collected through the Forms CPO-PQR and CTA-PR.

Accomplishments related to progress in achieving this goal include:

- Completed annual examinations of systemically important derivatives clearing organizations (SIDCOs), for which the Commission is the Supervisory Agency. The Commission selected the system safeguards core principle, with an emphasis on information security, for one SIDCO examination and selected seven core principles for the second examination.

- Evaluated additional swap products to determine the eligibility of derivatives clearing organizations (DCOs) to offer such products for clearing and conducted analysis to determine whether these swaps should be subject to a future clearing requirement.

- Granted DCO registrations to two clearing organizations, LCH.Clearnet SA and Singapore Exchange Derivatives Clearing Ltd. The Commission also vacated the DCO registration of New York Portfolio Clearing and amended a 4d order in order to facilitate the transfer of clearing services from New York Portfolio Clearing to ICE Clear Europe. Commission staff granted no-action relief to several foreign clearing organizations, permitting the clearing of proprietary swap positions for U.S. clearing members pending the clearing organizations’ registration as a DCO or exemption from registration.

- Completed reviews of DCO rules submitted to the Commission to ensure they were consistent with the CEA and Commission regulations. Rules include not only provisions contained in a DCO’s rulebook, but also issuances such as interpretations, policies, and clearing member advisories. During this performance period, 201 DCO rules were filed as self-certifications under Regulation 40.6 and seven rules were filed under Regulation 40.10, which requires that a SIDCO provide notice to the Commission not less than 60 days in advance of any proposed change to its rules, procedures, or operations that could materially affect the nature or level of risks presented by the SIDCO.

- Completed the “Derivatives Clearing Organizations and International Standards” rulemaking, effective on December 31, 2013, that established additional standards, which are consistent with the Principles for Financial Market Infrastructures published by the Committee on Payment and Settlement Systems and the Technical Committee of the International Organization of Securities Commissions (CPSS-IOSCO), for compliance with the DCO core principles set forth in the CEA for SIDCOs and DCOs that elect to opt-in to the SIDCO regulatory requirements.

- Completed the “Protection of Collateral of Counterparties to Uncleared Swaps” rulemaking, effective on January 6, 2014, that imposed requirements on SDs and major swap participants (MSPs) with respect to the treatment of collateral posted by their counterparties to margin, guarantee, or secure uncleared swaps.

- Issued proposed rules that would set margin requirements for uncleared swaps, on September 17, 2014. The rules are very similar to international standards that were issued in September 2013 and to rules that were recently proposed by the U.S. prudential regulators.

- Adopted new regulations and amended existing regulations to require enhanced customer protections, risk management programs, internal monitoring and controls, capital and liquidity standards, customer disclosures, and auditing and examination programs for FCMs.

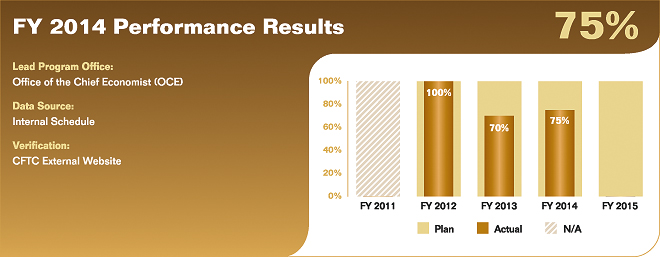

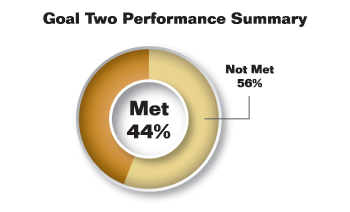

Goal Two performance measure results are depicted in the following table:

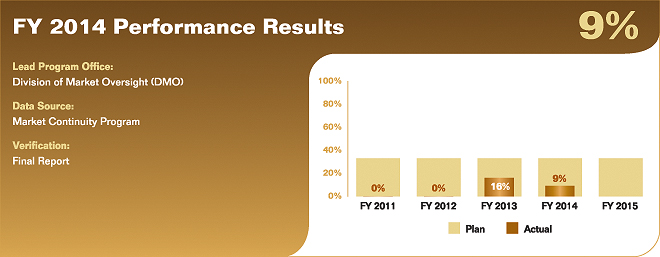

Goal Two Performance Results # of Measures Met Not Met Goal Two 18 8 10 % of Total 44% 56% -

Goal Two performance measures, analysis and review – Objective 2.1

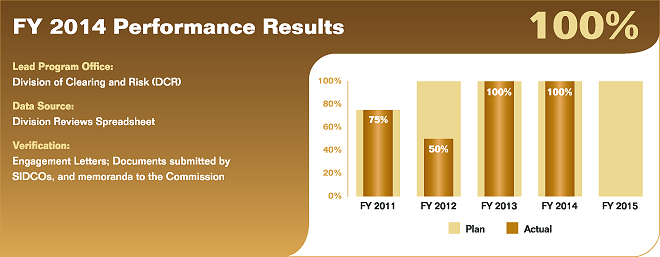

PERFORMANCE MEASURE 2.1.1.1 Review SIDCOs annually. Percentage of SIDCOs reviewed.

FY 2014 Target: 100%

Performance Analysis & Review

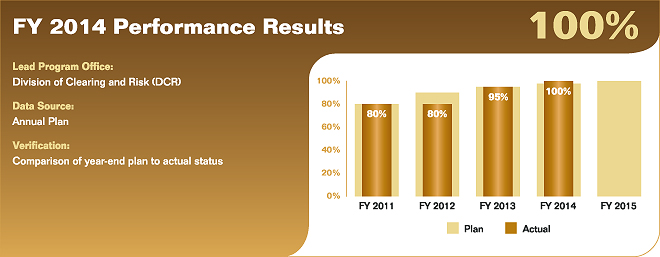

The performance target was met for FY 2014. The Examinations Group completed the annual examinations of those DCOs that have been designated, pursuant to Title VIII of the Dodd-Frank Act, as systemically important financial market infrastructures by the Financial Stability Oversight Council (FSOC) for which the CFTC is the Supervisory Agency (SIDCO). The Commission examined both SIDCOs during the year. The core principles selected for each examination were based upon a risk evaluation of each of the SIDCOs and the core principles selected included system safeguards, financial resources, risk management, governance fitness standards, conflicts of interest, and composition of governing boards. Multiple regulatory bodies participated in both examinations and the CFTC planned and coordinated all aspects of the examination process.

PERFORMANCE MEASURE 2.1.1.2 On a risk-based basis, review all other DCOs annually

to assess compliance with DCO core principles and Commission requirements.

FY 2014 Target: 100%

Performance Analysis & Review

The performance target was not met for FY 2014. The Commission was not able to meet this goal due to staffing limitations and the need to develop new examination programs to measure compliance with new regulations that became effective during the review period on liquidity risk management, risk management, and business continuity and disaster recovery plans and resources. In addition the Examinations Branch updated its examination program surrounding cyber security.

All DCOs submit quarterly filings to demonstrate compliance with the financial resource requirements. The CFTC received and analyzed 74 filings consisting of 50 quarterly filings, 12 monthly filings, and 12 certified filings during the performance period. In addition, the Examinations Branch received and analyzed 138 notice filings. Of those notifications, 50 pertained to hardware or software malfunction, cyber security incident, or targeted threat that materially impaired or created a significant likelihood of material impairment of automated systems and there was a need to review those filings promptly.

PERFORMANCE MEASURE 2.1.1.3 Percent of requests for Commission orders that are completed following review under the applicable provisions of the CEA.

FY 2014 Target: 96%

Performance Analysis & Review

The performance target was not met for FY 2014. The pending requests currently include: 1) a request from Southwest Power Pool, Inc. for an exemptive order under Section 4(c)(6) of the CEA; 2) a request from LCH.Clearnet, Ltd. for an amendment to its order of registration as a DCO that would permit it to provide clearing services for “swaps,” as defined in the CEA and Commission regulations, as well as all futures and options on futures; and 3) a request from ICE Clear Europe Limited for an order pursuant to Section 4d(a) of the CEA to revise its earlier order permitting portfolio margining of futures and foreign futures to expand the scope of the participants to include non-clearing FCMs. In FY 2014, the Commission issued an order to CME regarding the treatment of funds held in connection with the clearing of over-the-counter (OTC) wheat calendar swaps as well as an order to ICE Clear Europe Limited to permit commingling of customer funds in connection with futures and foreign futures contracts for products, including certain interest rate, energy, and financial contracts. For several of the requests, the Commission has completed substantial work but is waiting for further information from the requesters. In other cases, competing priorities mean that requests cannot be acted upon. Chief among the factors limiting progress is inadequate staffing. Risks of not achieving target include registrants not being able to implement business plans that would, if staff had resources to evaluate them, merit such orders. Conversely, the benefit of achieving the target is that registrants are able to implement merit-worthy business plans.

PERFORMANCE MEASURE 2.1.2.1 Applications are reviewed and a determination made regarding compliance with financial integrity provisions of the CEA within statutory time frames. Percent in compliance with financial integrity provisions.

FY 2014 Target: 100%

Performance Analysis & Review

The performance target was met for FY 2014. The Commission reviewed the DCM application of NASDAQ Futures, Inc., which was received in February 2014.

PERFORMANCE MEASURE 2.1.3.1 All material exceptions in monthly and annual financial filings

by FCMs and RFEDs and notices of noncompliance with respect to minimum capital and segregation

are reviewed and assessed within one business day. Percent completed within one business day.

FY 2014 Target: 100%

Performance Analysis & Review

The performance target was met for FY 2014. The Commission reviewed all 11 notices received within the targeted time of one business day. As appropriate, a follow up was performed with the filers and/or their designated self-regulatory organization (DSRO) to ensure that the fiscal integrity of the markets was maintained. Because segregated and secured funds are critical to the fiscal integrity of the market place and to customer financial protection, the ability to meet this target is vital to the Commission’s financial oversight mission.

PERFORMANCE MEASURE 2.1.3.2 On a risk-based basis, conduct direct examinations of FCMs

and RFEDs, identify deficiencies, and confirm that all deficiencies identified are corrected within

the specified period of time. Percent corrected within specified time period.

FY 2014 Target: 96%

Performance Analysis & Review

The performance target was not met for FY 2014. Although the Commission had planned to conduct limited-scope, risk-based examinations comparable in number to what had been performed in FY 2013 (13), only 11 examinations were performed in FY 2014 due primarily to prolonged resource constraints and other mission priorities. However, for these examinations, all deficiencies identified were corrected within the specified time period. The examinations performed in FY 2014 were very limited reviews that were reactive to the market place. In addition, the scope of the reviews was further reduced to target areas of greatest risk to the market or to firm customers. Examples of high risk focus areas include risks unique to the firm (as identified through the Commission’s monitoring process) and, as in the case of a liquidity review, the aspects of a firm’s operations most likely to cause harm to customers or threaten market financial integrity. Since 2011, examination production (which exceeded 30 reviews) has dropped by nearly 65 percent (to the 11 reviews conducted in FY 2014). If not addressed, the Commission believes that operational capacity will be further eroded by the work demands of SD/MSP oversight which in FY 2015 will demand additional staff time now that the initial registration process for these new registrants is nearing conclusion.

PERFORMANCE MEASURE 2.1.4.1 Reviews of swaps submitted to the Commission are completed within statutory and regulatory deadlines.

FY 2014 Target: 100%

Performance Analysis & Review

The performance target was not met for FY 2014. Section 2(h) of the CEA requires the Commission to determine whether to mandate clearing for swaps submitted to the Commission by registered DCOs (pursuant to Section 2(h) of the CEA and Regulation 39.5(b)), within 90 days of the Commission’s receipt of any such submission. The Commission also must post the submission for public comment during the 90-day period. During FY 2014, the Commission received 10 such submissions from registered DCOs, and staff of the DCR reviewed all of the submissions. However, the Commission neither posted any of those submissions for public comment nor issued any determinations as to whether the swaps covered by those submissions should be subject to a clearing requirement. In addition, the Commission did not take action on open submissions that had been received in FY 2013.

PERFORMANCE MEASURE 2.1.5.1 Reviews of DCO rules submitted to the Commission

are completed within statutory and regulatory deadlines.

FY 2014 Target: 100%

Performance Analysis & Review

The performance target was met for FY 2014. During FY 2014, 201 DCO rules were filed as self-certifications under Regulation 40.6 and seven rules were filed under Regulation 40.10, which requires that a SIDCO provide notice to the Commission not less than 60 days in advance of any proposed change to its rules, procedures, or operations that could materially affect the nature or level of risks presented by the SIDCO. Delays with respect to rules filed pursuant to Regulation 40.10 are, in part, due to inadequate information supplied by the registrant. In other cases, delays arose due to inadequate staffing. Risks of not achieving target include registrants not being able to implement rules that would, if staff had resources to evaluate them, merit prompt approval, or more prompt delineation of missing information. Conversely, the benefit of achieving the target is that registrants are able to implement merit-worthy rules, or more promptly learn of staff concerns with proposed rules.

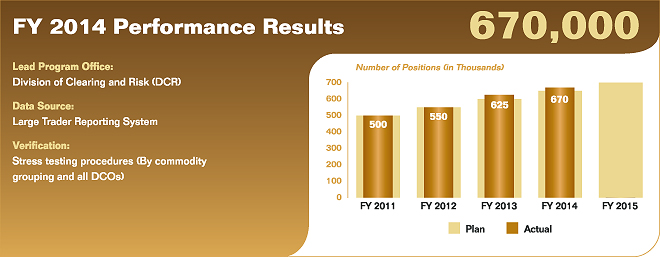

PERFORMANCE MEASURE 2.1.6.1 Perform risk analysis and stress-testing on large trader and

clearing member positions to ascertain those with significant risk and confirm that such risks

are being appropriately managed. Number of positions analyzed.

FY 2014 Target: 650,000

Performance Analysis & Review

The performance target was met for FY 2014. Risk surveillance tools have been enhanced to allow for more comprehensive stress testing. The Stressing Positions at Risk (SPARK) application has been greatly enhanced to allow for automated stress testing. Additionally, the Risk Surveillance Branch has developed credit default swap (CDS) and interest rate swap (IRS) risk surveillance capabilities.

Staff members conduct daily stress tests of energy, interest rate, equities, agricultural, soft agricultural, and metals account and firm positions. Stress tests are performed at a variety of levels (e.g., all time move and 150 percent of product margin requirements) and results are compared to a variety of metrics (e.g., excess net capital and margin on deposit). Stress tests are also performed across multiple commodity groups.

The CFTC conducted a wide variety of risk analysis on large trader and clearing member positions, relying primarily on the Integrated Surveillance System (ISS) and SPARK databases in conjunction with Standard Portfolio Analysis of Risk (SPAN®) Risk Manager Software. In addition, staff conducted financial analysis of clearing members using Regulatory Statement Review (RSR) Express. Through the use of these and other systems Commission staff members identify traders with the greatest overall market risk and those that pose a material risk to their clearing members.

PERFORMANCE MEASURE 2.1.6.2 On a risk-based basis, meet with large traders, FCMs, SDs,

and other industry participants to discuss risk management issues. Number of entities met with

and risk issues reviewed.

FY 2014 Target: 143

Performance Analysis & Review

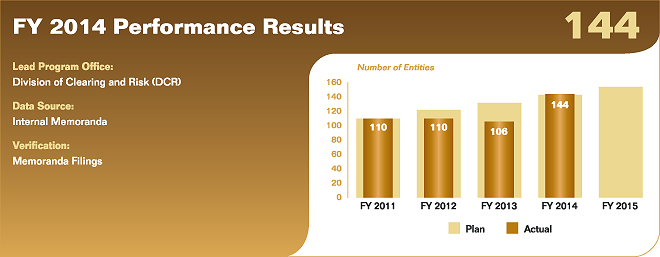

The performance target was met for FY 2014. Travel funds were sufficient for staff to perform several New York and other out of state regulation 1.73 and trader risk reviews. Traders with large risk relative to the size of their clearing firm and traders with risk across multiple firms or DCOs were selected for risk reviews. Additionally, DCR staff were able to meet with risk management staff at several larger firms to discuss each specific firm’s risk across origins and DCOs.

In FY 2014, the Commission conducted the most Regulation 1.73 reviews in the brief history of the program. These reviews include review and evaluation of firm risk surveillance procedures and output. The reviews also involve observing and evaluating risk surveillance procedures.

-

Goal Two performance measures, analysis and review – Objective 2.2

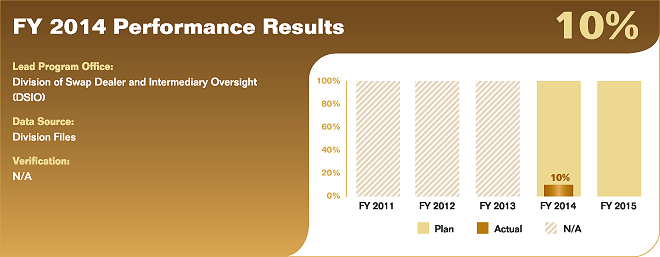

PERFORMANCE MEASURE 2.2.1.1 Conduct direct examinations of swap dealers and major swap participants to identify deficiencies, and confirm that all deficiencies identified are corrected within specified period of time.

FY 2014 Target: 100%

Performance Analysis & Review

The performance target was not met for FY 2014. Due to a continued lack of necessary staffing resources, no SD/MSP reviews were planned in FY 2014. However, the Commission was required to perform one SD exam in direct response to a significant trading issue. This SD exam resulted in the deficiencies being corrected by the firm within the specified time period. Since the Commission has no base examination resources to conduct SD/MSP reviews, performing this review came at the expense of other priority areas, further impacting the CFTC’s ability to meet examination performance targets.

PERFORMANCE MEASURE 2.2.2.1 Under a risk-based approach, conduct reviews of selected

programs of all RFAs to assess fulfillment of statutory and delegated responsibilities and confirm

that any deficiencies identified are corrected within the specified period of time. Percent of

deficiencies corrected within specified time period.

FY 2014 Target: 96%

Performance Analysis & Review

The performance target was not met for FY 2014. The workload demands of the Dodd-Frank Act rule implementation in combination with resource constraints resulted in the inability to conduct reviews of registered futures associations (RFAs). The lack of RFA program reviews by the Commission may result in deficiencies going uncorrected and impairment of the Commission’s regulatory mission. The Commission plans to continue its work to identify staffing efficiencies and explore other alternatives to identify the dedicated resources necessary to complete this measure.

PERFORMANCE MEASURE 2.2.2.2 Percentage of RFA rules submitted for which determinations

are made within statutory time frames.

FY 2014 Target: 96%

Performance Analysis & Review

The performance target was met for FY 2014. All RFA rules submitted were evaluated and appropriate determinations were completed within the time allowance required by the measure. Examples of RFA rules evaluated during the performance year included National Futures Association (NFA): Submission of Swap Dealer and Major Swap Participant Filings Through WinJammer™—NFA Compliance Rule 2-49 Regarding Swap Dealers and Major Swap Participants Regulations and NFA: Decrease in Membership Dues for Major Swap Participants—NFA Bylaw 1301 Regarding Schedule of Dues and Assessments.

PERFORMANCE MEASURE 2.2.3.1 On a risk-based basis, conduct direct examinations of non-FCM intermediaries, identify deficiencies, and confirm that any deficiencies identified are corrected within the specified period of time. Percent of time that deficiencies are corrected within specified time period.

FY 2014 Target: 96%

Performance Analysis & Review

The performance target was not met for FY 2014. The Commission chose not to review any non-FCM intermediaries in favor of relying on NFA to perform such examinations given limited resources and the ongoing need to prioritize tasks based on overall importance to the financial markets, customer protection, and other factors. As the new SD/MSP registration process continues, there will be an even greater need to balance and prioritize the allocation of staff resources moving forward.

-

Goal Two performance measures, analysis and review – Objective 2.3

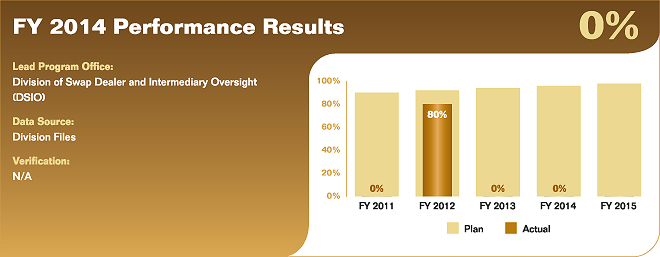

PERFORMANCE MEASURE 2.3.1.1 On a risk-based basis, review all SROs annually to assess compliance with CEA and Commission requirements, identify deficiencies, and confirm that any deficiencies identified are corrected within the specified period of time. Percent of time in which deficiencies are corrected within specified time period.

FY 2014 Target: 96%

Performance Analysis & Review

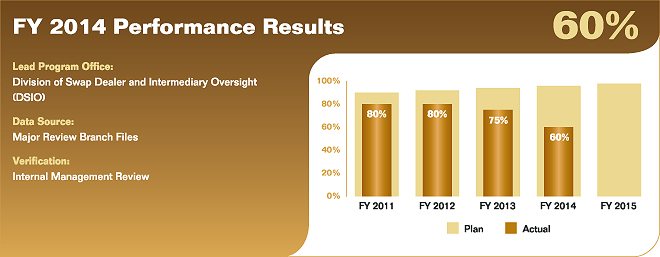

The performance target was not met in FY 2014. The Commission reviews self-regulatory organizations (SROs) to assess compliance with the CEA and Commission requirements. Due to resource constraints, only six out of the 10 (60 percent) planned reviews were completed and none of the draft reports were submitted to the affected SROs in final form. Nevertheless, all reviews were completed in a thorough and timely manner and any significant issues or findings were communicated to the SRO immediately. As budgetary and staffing constraints continue, the Commission will maintain its efforts to seek innovative ways to complete and finalize these reviews.

PERFORMANCE MEASURE 2.3.1.2 Percentage of direct examinations of registered intermediaries

that confirm proper execution of SRO programs.

FY 2014 Target: 96%

Performance Analysis & Review

The performance target was not met in FY 2014. Due to a continued decline in available examination staff caused by attrition and initial budget constraints and the operational need to allocate limited resources to address other critical priorities, the Commission completed only five of the 20 limited scope reviews. Nevertheless, the CFTC maintained ongoing dialogue with the SROs throughout the fiscal year on examinations issues.

-

Goal Two performance measures, analysis and review – Objective 2.4

PERFORMANCE MEASURE 2.4.1.1 Program redesign to cover new registrants monitored

by the RSR and SPARK systems. Percentage of system redesign accomplished.

FY 2014 Target: 98%

Performance Analysis & Review

The performance target was met for FY 2014. All planned enhancements to the SPARK application have been made in the past year. Stress testing capabilities have been greatly enhanced. Search capabilities have also been enhanced. Part 39 query capabilities have been added to the application. The RSR application has been updated to accept DCO filings.

The Commission conducted risk surveillance activities through the use of automated financial and risk surveillance systems and applications such as RSR Express and SPARK databases. Staff members use RSR Express to receive and review monthly FCMs financial statements; and SPARK to identify volatile markets, firms that have positions on the losing side of the market, and customers at the identified firms. Large trader positions are downloaded into an application that allows for the margining and stress testing of positions. Both RSR Express and SPARK applications were developed in-house.

PERFORMANCE MEASURE 2.4.1.2 Program design to cover new data collection requirements

to monitor systemic risk posed by CPOs and CTAs advising private funds, and new registration

of swap dealers. Percentage of system design accomplished.

FY 2014 Target: 98%

Performance Analysis & Review

The performance target was not met in FY 2014. Although an initial framework regarding the use of CPO/CTA data is in place, the CFTC’s goal to provide this data to the FSOC regarding systemic risk and to participate in the IOSCO hedge fund survey continues to be negatively impacted by resource constraints. Moving forward, the Commission will seek to identify resource solutions and efficiencies to continue progress on this mission critical goal.

-

-

-

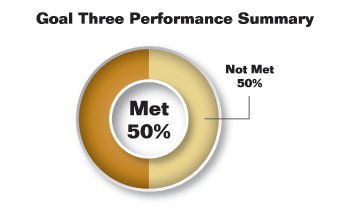

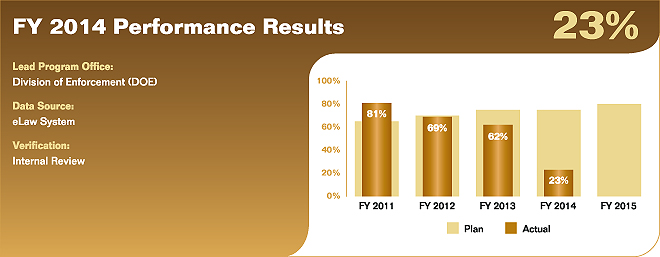

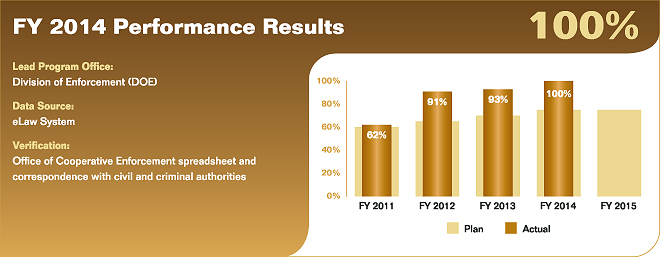

Goal Three—Protect the public and market participants through a robust enforcement program.

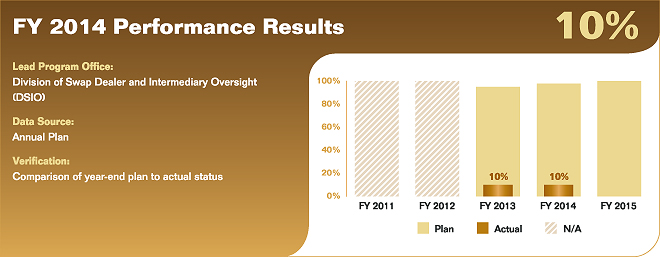

The Commission is committed to prosecuting violations of the CEA and Commission regulations to protect market participants and promote market and financial integrity. The DOE investigation and litigation matters are broadly categorized into four areas: 1) manipulation, 2) trade practice,3 3) fraud, and 4) supervision and control. The CFTC filed 67 enforcement actions in FY 2014 and obtained $3.27 billion in sanctions that includes more than $1.8 billion in civil monetary penalties (CMPs) and more than $1.4 billion in restitution and disgorgement. This brings the Commission’s total monetary sanctions over the past two fiscal years to more than $6 billion, which is more than the total sanctions imposed during the prior 10 fiscal years combined. In addition, the Commission: