Significant Dates in CFTC History — 2000s

Table Of Contents

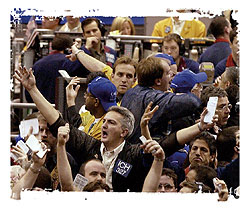

CME Trading Floor, 2002.

Photo provided by Chicago Mercantile Exchange

CME S&P Pit.

CME-NYSE AP photo provided by Chicago Mercantile Exchange

CBOT Trading Floor, 2005.

Photo provided by Chicago Board of Trade

February 22, 2000—The CFTC transmits to Congress a staff report, A New Regulatory Framework, which recommends changes to the CFTC’s regulatory structure. The report details changes that will lessen the regulatory burdens on U.S. futures markets by creating a more flexible regulatory framework. At the same time, the framework provides the OTC markets with greater legal certainty. Much of this framework will be incorporated into the CFMA.

September 14, 2000—The CFTC and SEC announce an agreement providing for joint jurisdiction over security futures products, that is, single stock futures and futures on narrow-based stock indexes. Under the agreement, which will be incorporated into the CFMA, the CFTC retains exclusive jurisdiction over futures contracts on broad-based stock indexes.

December 21, 2000—President Clinton signs into law the CFMA, which, among other things, reauthorizes the Commission for five years, overhauls the CEA to create a flexible structure for the regulation of futures and options trading, clarifies Commission jurisdiction over certain retail foreign currency transactions, and repeals the 18-year-old ban on the trading of single stock futures.

April 18, 2001—For the first time since the passage of the CFMA, the CFTC uses its newly clarified authority to file a complaint charging fraud and the offering of illegal futures contracts against a firm soliciting retail investors to trade foreign currency contracts. Over the next several years, the CFTC filed similar complaints against dozens of firms that solicit retail investors to trade foreign currency.

July 9, 2001—The CFTC approves the application of EnergyClear Corporation for registration as a DCO under the CEA. This is the first new DCO that is not affiliated with a trading facility to be granted registration by the Commission since the passage of the CFMA. DCOs for the existing futures exchanges were grandfathered in under the CFMA.

August 1, 2001—The CFTC kicks off implementation of the CFMA by adopting new rules for the various types of exchanges (with different levels of regulatory oversight) that the CFMA created. These types of exchanges include designated contract markets, derivatives transaction execution facilities, exempt boards of trade, and exempt commercial markets.

August 21, 2001—The CFTC orders Avista Energy, Inc. to pay $2.1 million to settle CFTC charges of manipulating electricity futures.

August 22, 2001—The CFTC adopts new rules for derivatives clearing organizations, further implementing the CFMA.

September 11, 2001—The CFTC New York office is destroyed during the terrorist attack against the World Trade Center. Commission staff escape without serious injury.

July 1, 2002—The CFTC restructures its staff organization to facilitate the implementation of the CFMA. Under the restructuring, the functions previously performed by the Division of Trading and Markets and the Division of Economic Analysis are performed by two new divisions and one new office: the Division of Market Oversight, the Division of Clearing and Intermediary Oversight, and the Office of the Chief Economist.

November 8, 2002—Trading in single stock futures is launched on two new exchanges: OneChicago and NQLX.

March 12, 2003—The CFTC charges the bankrupt Enron Corporation and a former Enron vice president with manipulating prices in the natural gas market. Enron also is charged with operating an illegal, undesignated futures exchange and offering illegal lumber futures contracts through Enron Online, its Internet trading platform. Enron settles in May 2004 and the trader settles in July 2004.

July 15, 2003—The CFTC approves exchange rules implementing a common clearing link between the CBOT and CME.

Fiscal Year 2003—The CFTC approves or (in most cases) accepts the exchange self-certification of a record 348 new futures and option contracts during fiscal year 2003. While about 200 of these new contracts are single stock futures, the number of new non-single stock futures contracts easily exceeds the old record of 92 new contracts set in Fiscal Year 1996.

November 18, 2003—The CFTC joins other members of the President’s Corporate Fraud Task Force in undercover “Operation Wooden Nickel” to prosecute individuals and companies allegedly stealing millions of dollars through sales of illegal foreign currency futures contracts.

February 4, 2004—The CFTC designates the USFE, also known as Eurex US, as a contract market for the automated trading of futures and options on futures contracts. This is the first designated contract market to be owned by a foreign futures exchange.

October 13, 2005—The CFTC issues a statement regarding the bankruptcy filing of Refco. Ultimately, customers holding position is futures contracts through the firms CFTC registered FCM subsidiary are repaid in full from funds in the segregated customer accounts.

December 19, 2006—15 defendants from “Operation Wooden Nickel” ordered by U.S. District Court (SDNY) to pay restitution return ill-gotten gains and pay fines totaling over $25 million. Penalties were imposed subsequently on nine additional defendants. During this time period the investigation and litigation of fraud in retail forex is the largest area of the CFTC’s anti-fraud enforcement program.

July 12, 2007—The CME and the CBOT announced the completion of their merger creating the world’s largest exchange.

July 25, 2007—The CFTC charges hedge fund Amaranth with attempted manipulation in the price of natural gas. Since December 2002, the Commission has imposed over $300 million in civil monetary penalties for manipulation, attempted manipulation and false price reporting in the energy markets.

September 18, 2007—The CFTC held a hearing to examine trading on regulated exchanges and ECMs as part of the Commission’s on going review of energy futures trading.

October 24, 2007—The CFTC delivers to Congress a report that includes recommendations to increase the oversight of some trading activity on electronic trading facilities known as ECMs.

October 25, 2007—British Petroleum agrees to pay a total of $303 million in sanctions to settle charges of manipulation and attempted manipulation in the propane market.

| FY 2000 |

FY 2001 |

FY 2002 |

FY 2003 |

FY 2004 |

FY 2005 |

FY 2006 |

FY 2007 |

|

|---|---|---|---|---|---|---|---|---|

| Actual FTE | 556 | 546 | 509 | 521 | 517 | 487 | 493 | 437 |

| Approved Appropriation | $63 | $71 | $88 | $85 | $90 | $94 | $97 | $98 |