- Overview of the FY 2014 Budget & Performance Plan

- Summary of FY 2014 Budget Request by Mission Activity

- Summary of FY 2014 Budget Request by Division

- Summary of FY 2014 Budget Request by Object Class

- Crosswalk from FY 2013 Budget to FY 2014 Request

- Crosswalk from FY 2013 Continuing Resolution to FY 2014 Request

- Statement of Availability on Basis of Obligations

- Statement of Availability on Basis of Appropriation by Program

- Mission Activities

- Divisions

The Division of Enforcement (DOE) program investigates and prosecutes alleged violations of the CEA and Commission regulations. Possible violations involve improper conduct related to commodity derivatives trading on U.S. exchanges, or the improper marketing and sales of commodity derivatives products to the general public.

In FY 2012, the Commission filed 102 enforcement actions, the highest annual number of filings in program history, and opened more than 350 new investigations. During the same period the Commission obtained orders imposing over $475 million in civil monetary penalties, and directing the payment of more than $456 million in restitution and disgorgement, which was a Commission record for the imposition of such sanctions during the fiscal year. At the same time, the FTE resources dedicated to the DOE program are now essentially level with those it had nearly a decade ago to support a much smaller docket (in size and complexity).

The Dodd-Frank Act significantly enhances and expands the Commission's powers and responsibilities and will result in a substantial increase in our workload. Moreover, the size of the docket stemming from pre-Dodd-Frank Act enforcement authorities, particularly with respect to the investigation and prosecution of frauds against retail customers, manipulation, supervision failures, recordkeeping, reporting and trade practice violations, is projected to continue its upward trend.

By FY 2014, the Commission's enforcement workload will increase for a number of reasons including:

- Addition of fraud-based manipulation to the Commission's existing "price-based" anti-manipulation authority;

- New prohibitions targeting disruptive trading practices and conduct on registered entities;

- Establishment of anti-fraud and anti-manipulation authority over swaps;

- New prohibitions against reporting false information;

- Clarified jurisdiction with respect retail foreign currency transactions and new authority over retail commodity transactions such as precious metals;

- Increase in the number and types of registrants, including exchanges, SEFs, SDRs, clearing organizations, intermediaries and dealers;

- New regulations applying to swaps and other intermediaries including those involving business conduct standards, fraud, record-keeping, reporting and trade practice; and

- An increase in international scope of activities.

The enforcement activity generated by this broadened regulatory authority will necessitate the development of specific areas of expertise, and require an increased capacity for proactive identification of violations.

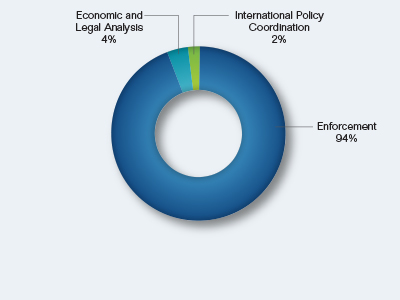

FY 2014 Budget Overview by Mission Activity

| FTE | Salaries and Expenses | IT | Total | |

|---|---|---|---|---|

| Enforcement | 203 | $48,390 | $0 | $48,390 |

| Economic and Legal Analysis | 9 | 2,150 | 0 | 2,150 |

| International Policy Coordination | 3 | 720 | 0 | 720 |

| Total | 215 | $51,260 | $0 | $51,260 |

Enforcement Request by Mission Activity

Top FY 2012 Accomplishments

Filed 102 enforcement actions, the highest yearly tally in the agency's history. The CFTC charged individuals and companies in these cases for manipulating commodity prices, perpetrating Ponzi schemes and other fraud, supervision and accounting failures, trading abuses, registration deficiencies, and committing other violations of the CEA and regulations.

Opened more than 350 investigations.

Obtained orders imposing over $475 million in civil monetary penalties, and directing the payment of more than $456 million in restitution and disgorgement, which was a Commission yearly record and more than doubled the prior fiscal year's imposition of such sanctions.1

Actively engaged in cooperative enforcement with federal and state criminal and civil law enforcement authorities. During FY 2012, 94 percent of the CFTC's major injunctive fraud cases involved related criminal investigations. During this time, over 50 criminal indictments and judgments were filed that were related to CFTC enforcement matters. The CFTC also engaged in cooperative enforcement efforts with civil regulatory agencies, and approximately 50 percent of the major fraud actions involving related criminal investigations also involved parallel investigations with federal civil authorities.

Engaged in cooperative enforcement with international authorities in a wide range of matters from retail fraud to market manipulation. The Division routinely works with international financial regulatory and criminal counterparts on multi-jurisdictional and multi-national investigations. During FY 2012, the Commission handled 446 international requests and referrals. The Commission also entered into bilateral cooperative enforcement/information sharing arrangements with more than twenty-five (25) foreign authorities.

Top FY 2013 President's Budget & Performance Planned Outcomes

The maintenance of current levels of enforcement activity based upon pre-Dodd Frank authorities, particularly with respect to the investigation and prosecution of frauds against retail customers, manipulation, supervision failures, record-keeping, reporting and trade practice violations.

The continued expansion of enforcement activity involving manipulation, disruptive trading, swaps and retail commodity transactions based upon new Dodd Frank authorities.

Continued evaluation and improvement of effectiveness in investigations and pursuit of violative activity which affects the public, markets and market participants.

The enforcement program in FY 2013 will continue to be guided by new and expanded enforcement authorities provided by the Dodd-Frank Act. These include the addition of fraud-based manipulation to the Commission's existing anti-manipulation authority, prohibitions targeting disruptive trading practices and other misconduct on registered entities, anti-fraud and anti-manipulation authority over swaps, clarified jurisdiction with respect to retail foreign currency transactions, and new authority over cash commodity transactions such as those involving precious metals.

Under the Dodd-Frank Act the Commission anticipates that significant increases in the number of registrants concerning swaps related activity will commence in FY 2013. Increases in the number of registrants and associated trading activity will likely increase the enforcement burden with regard to the investigation and prosecution of regulatory compliance failures (including business conduct standards), fraud, record-keeping, reporting and trade practice violations.

Top FY 2014 President's Budget & Performance Planned Outcomes

Continued growth in enforcement cases filed under the new jurisdiction and enforcement powers provided under Dodd Frank including fraud based manipulation, manipulation authority over OTC trading, and enforcement of new false reporting prohibitions.

The deliberate and specialized growth of swaps enforcement activities and expertise.

Increased automation of investigation, discovery, forensics, evidentiary analysis, and case management. Implementation of new tools for forensics, eDiscovery, tips and referrals, and early case assessment together with enhancement of existing tools for deposition management, case management, searching, and analytics will support both a higher volume of investigations and more effective measurement of program results.

New case filings in FY 2012 and FY 2013 will carry a "delayed" resource burden in FY 2014 as those matters are litigated through the federal courts.

Domestic and international cooperative enforcement efforts will continue to be a force. The Commission has seen a significant increase in both the number of outgoing and incoming international requests over the last several years. This increase is directly related to the increase in enforcement cases in general, thus an escalation in international activity is expected to continue through FY 2014 and beyond.

1 As of February 11, 2013, the Commission obtained orders imposing over $1,322 million in civil monetary penalties, which is a Commission yearly record and nearly triples the prior fiscal year's imposition of sanctions. (back to text)