- Overview of the FY 2014 Budget & Performance Plan

- Summary of FY 2014 Budget Request by Mission Activity

- Summary of FY 2014 Budget Request by Division

- Summary of FY 2014 Budget Request by Object Class

- Crosswalk from FY 2013 Budget to FY 2014 Request

- Crosswalk from FY 2013 Continuing Resolution to FY 2014 Request

- Statement of Availability on Basis of Obligations

- Statement of Availability on Basis of Appropriation by Program

- Mission Activities

- Divisions

The global nature of the futures and swaps markets makes it imperative that the United States consult and coordinate with foreign authorities. The Commission is actively communicating internationally to promote robust and consistent standards and avoid conflicting requirements, wherever possible. For example, the Commission has engaged in bilateral discussions and shared many of our pre-decisional memos, term sheets and draft proposals with international regulators, such as the European Commission, the European Central Bank, the United Kingdom Financial Services Authority and the new European Securities and Markets Authority. The Commission participates in numerous international working groups regarding swaps, including the International Organization of Securities Commissions (IOSCO) Task Force on OTC Derivatives, which the CFTC co-chairs. The CFTC, SEC, European Commission and European Securities Market Authority are intensifying discussions through a technical working group. The Commission also is consulting with many other jurisdictions such as Hong Kong, Singapore, Japan, and Canada. Discussions have focused on the details of the Dodd-Frank rules, including mandatory clearing, trading, reporting and regulation of derivatives market intermediaries. The Commission's international outreach efforts directly support global consistency in the oversight of the swaps markets.

In addition, the Commission anticipates a need for on-going international policy coordination related to cross-border implementation of semi-independent regulatory environments for swap markets. The Commission also anticipates a need for ongoing international work and coordination in the development of data and reporting standards under Dodd-Frank rules. This important, evolving aspect of CFTC's mission is specifically addressed in Goal Four of the Strategic Plan.

Summary

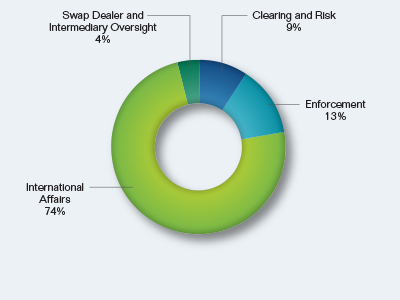

Organizationally, the Commission's international policy coordination mission support related resources will support the Commission-wide requirements of four Divisions:

| FTE | Salaries and Expenses | IT | Total | |

|---|---|---|---|---|

| Clearing and Risk | 2 | $480 | $0 | $480 |

| Enforcement | 3 | 720 | 0 | 720 |

| International Affairs | 17 | 4,040 | 0 | 4,040 |

| Swap Dealer and Intermediary Oversight | 1 | 240 | 0 | 240 |

| Total | 23 | $5,480 | $0 | $5,480 |

International Policy Coordination Request by Division