- Overview of the FY 2014 Budget & Performance Plan

- Summary of FY 2014 Budget Request by Mission Activity

- Summary of FY 2014 Budget Request by Division

- Summary of FY 2014 Budget Request by Object Class

- Crosswalk from FY 2013 Budget to FY 2014 Request

- Crosswalk from FY 2013 Continuing Resolution to FY 2014 Request

- Statement of Availability on Basis of Obligations

- Statement of Availability on Basis of Appropriation by Program

- Mission Activities

- Divisions

Commission-wide economic analysis

As the Commission's statutory and regulatory mandate vastly expands, it is imperative the Commission continues to invest in building robust economic analysis teams.

The Commission supports an in-depth, analytical research program that focuses on innovations in trading technology, developments in trading instruments, and the role of market participants in the futures, options, and swap markets. This team of specialized economists supports the Commission's numerous divisions by analyzing these constantly evolving market components to help anticipate and mitigate significant regulatory, surveillance, clearing, and enforcement challenges. Economic expertise is especially important for the development and implementation of new financial regulations related to the Dodd Frank Act and the oversight of a new swaps regime.

Economic analysis is pervasive in supporting the regulatory activities in:

- Assessing whether newly developed products/contracts have a price discovery function and whether those products/contracts are eligible for trading;

- Determining the requirements for reporting and data rules;

- Developing analytical tools and methods in support of the Commission's automated surveillance initiatives, especially as they pertain to SEFs and the connections between SEFs and DCMs;

- Determining whether certain products/contracts are eligible for clearing and the levels for capital and margin;

- Valuation of complex swaps in support of clearing functions;

- Assessing the impact of position limits on markets; and

- Developing analytical tools and methods in support of the Commission's enforcement activities, including economic and statistical analysis or expert testimony to promote compliance with and deter violations of the CEA.

The Commission is committed to integrating robust economic analysis into its regulatory activities and has established a network of well-renowned researchers and academics in quantitative financial methods, applied mathematics, econometrics, and statistics. Furthermore, the Commission's continued engagement with an extended network of experts across the Federal government has fostered the necessary dialogue to promote a common framework for interagency consensus-building. For example, the Commission's involvement with the Financial Stability Oversight Council (FSOC) ensures financial regulatory agencies communicate perceived financial and economic issues with one another. This dialogue allows for a well-coordinated approach to address these potential issues.

Commission-wide legal counsel

The Commission's legal activities include: 1) regulatory issues; 2) engaging in defensive, appellate, and amicus curiae litigation; 3) providing general legal advice and support; 4) assisting the Commission in the performance of its adjudicatory functions; and 5) providing advice on legislative and other intergovernmental affairs issues.

- Regulatory Issues. The Commission's legal analysis teams provide interpretations of Commission statutory and regulatory authority and, where appropriate, provide exemptive, interpretive, and no-action letters to regulatees and potential regulatees of the Commission. This activity also includes drafting Commission regulations as well as providing legal counsel in support of all substantial Commission actions, including registrations, Commission rules and regulations, product reviews and market and clearing issues. Regulatory analyses ensure compliance with laws of government-wide applicability, such as the Administrative Procedure Act, the Regulatory Flexibility Act, and the Paperwork Reduction Act. In FY 2013 and 2014, the Commission expects an increase in the number of requests for written interpretations and no-action letters.

- Litigation Program. Through the litigation program, legal teams represent the Commission in appellate litigation, including participation as amicus curiae; certain trial-level cases, including bankruptcy cases involving derivatives industry professionals; and certain kinds of administrative litigation. Following the implementation of Dodd-Frank Act regulations, the Commission anticipates a significant amount of litigation in FY 2013 and FY 2014. The Commission also maintains the capability to manage personnel, labor, contract, and employment law matters, including cases arising under Title VII of the Civil Rights Act of 1964 and other antidiscrimination statutes, and Merit Systems Protection Board cases arising under the Civil Service Reform Act of 1978.

- General Law. The Commission manages its Information Governance Program in compliance with applicable laws as part of its General Law responsibilities. This program includes three major activities: Freedom of Information Act (FOIA) compliance, the Privacy Act, and Electronic Discovery (e-Discovery). The Commission maintains a robust capability with respect to all matters related to information requests and implements the processes, policies, and information systems to ensure that the Commission appropriately manages electronically stored information as set forth in the Federal Rules of Civil Procedure and relevant judicial decisions. As the enforcement caseload increases, the program's role in advising and responding to information requests will increase.

The Commission's General Law activities ensure compliance with the Government in the Sunshine and Federal Advisory Committee Acts. The program also advises the Commission on all policies affecting personnel, agency practices and procedures, as well as providing advice and guidance in procurement matters. In addition, the program manages all matters related to the Commission's ethics standards and compliance with its Code of Conduct, as well as with government-wide ethics regulations promulgated by the Office of Government Ethics.

- Adjudicatory Opinions. Through its opinions activities, the Commission responds to appeals regarding decisions by an Administrative Law Judge or a Judgment Officer in administrative reparations or enforcement actions.

- Legislation and Intergovernmental Affairs. Through its intergovernmental affairs activities, the Commission monitors, reviews, and comments on proposed legislation affecting the Commission or the derivatives industry, and prepares technical assistance regarding draft legislation as requested by members of Congress or their staff. Additionally, the program staff liaisons with other Federal regulators to analyze and resolve jurisdictional issues, as well as address specific matters implicating the jurisdiction of multiple agencies. The Commission anticipates a sustained level of effort in FY 2014 in legal work relating to the FSOC.

Summary

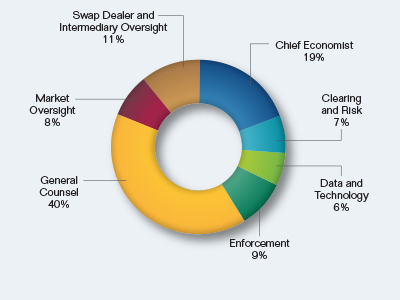

Organizationally, the Commission's resources related to economic analysis and legal counsel mission activity will support the Commission-wide requirements through seven Divisions:

| FTE | Salaries and Expenses | IT | Total | |

|---|---|---|---|---|

| Chief Economist | 20 | $4,760 | $0 | $4,760 |

| Clearing and Risk | 7 | 1,670 | 0 | 1,670 |

| Data and Technology | 0 | 0 | 1,440 | 1,440 |

| Enforcement | 9 | 2,150 | 0 | 2,150 |

| General Counsel | 41 | 9,780 | 0 | 9,780 |

| Market Oversight | 8 | 1,910 | 0 | 1,910 |

| Swap Dealer and Intermediary Oversight | 12 | 2,860 | 0 | 2,860 |

| Total | 97 | $23,130 | $1,440 | $24,570 |

Economic Analysis and Legal Counsel Request by Division