- Overview of the FY 2014 Budget & Performance Plan

- Summary of FY 2014 Budget Request by Mission Activity

- Summary of FY 2014 Budget Request by Division

- Summary of FY 2014 Budget Request by Object Class

- Crosswalk from FY 2013 Budget to FY 2014 Request

- Crosswalk from FY 2013 Continuing Resolution to FY 2014 Request

- Statement of Availability on Basis of Obligations

- Statement of Availability on Basis of Appropriation by Program

- Mission Activities

- Divisions

The Commission performs a thorough review of the registration applications of all entities seeking to be registered as DCMs, SDRs, DCOs, and soon SEFs. Multi-disciplinary review teams of attorneys, industry economists, trade practice analysts, data analysts, and risk analysts are needed to ensure that the Commission undertakes a thorough analysis of such applications to ensure compliance with the applicable statutory core principles and Commission regulations. Site visits may be required to validate needed technical and self-regulatory capabilities.

- In developing the FY 2013 President's Budget, the Commission anticipated that the rules relating to the registration requirements for entities would be completed in FY 2012, and that much of the increase in registration and product review activities would begin in 2012 and be essentially complete in the first quarter of FY 2013.

- In addition to performing direct registration of new entities, the CFTC staff will perform reviews to ensure compliance with the CEA's (as amended) core principles. Likewise, registered entities must submit changes to their rules of operation to the CFTC on an on-going basis.

- Current projections for FY 2013 and 2014 indicate that registration related activities will increase significantly over last year's projections, with an estimated 12 percent of CFTC staff devoted to registration related activities in FY 2013. This level of efforts declines to approximately 107 staff years, or eleven percent of all CFTC staff efforts, in FY 2014. These activities include direct registration and rules of operations reviews of DCMs, SEFs, SDRs, and DCOs, as well as oversight of the National Futures Association's (NFA) registration of swap dealers, major swap participants, futures commission merchants (FCM), and other market participants. While the registration of new entities essentially will be complete in FY 2013, the 2014 level of effort is driven by expected increases in workload due to the cross-border scope of the Dodd-Frank Act and rule filings as the increased number of entities continue to implement and refine their rules of operation under the new regulatory framework.

Summary

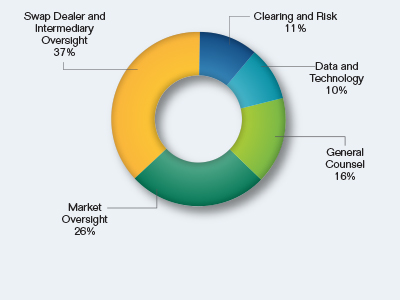

Organizationally, the Commission's registration and registration compliance related resources will support the requirements of five Divisions:

| FTE | Salaries and Expenses | IT | Total | |

|---|---|---|---|---|

| Clearing and Risk | 13 | $3,100 | $0 | $3,100 |

| Data and Technology | 0 | 0 | 2,850 | 2,850 |

| General Counsel | 19 | 4,530 | 0 | 4,530 |

| Market Oversight | 31 | 7,390 | 0 | 7,390 |

| Swap Dealer and Intermediary Oversight | 44 | 10,490 | 0 | 10,490 |

| Total | 107 | $25,510 | $2,850 | $28,360 |

Registration and Registration Compliance Request by Division