In testimony earlier this year before the House and Senate Agriculture Committees, then Acting Commodity Futures Trading Commission (CFTC) Chairman Sharon Brown-Hruska acknowledged that some of the goals of the Commodity Futures Modernization Act (CFMA) had not been achieved. Of significant concern to the CFTC is that more progress has not been made with respect to implementing risk-based portfolio margining for security futures products, particularly in light of instructions from the Board of Governors of the Federal Reserve System (Fed) in delegating margin authority for these products. Now that the New York Stock Exchange (NYSE) has joined with the futures and options industries in supporting legislation to further the cause of risk-based portfolio margining, it is time to keep pace with the global marketplace and modernize the margining of financial instruments.

The focal point is the Commodity Exchange Act reauthorization bill, which has revived discussions about security futures products and the way they are margined. While the options exchanges, the NYSE, and the Chicago Mercantile Exchange each have their own ideas about how Congress and the regulators – the CFTC and the Securities and Exchange Commission (SEC) – should proceed, all seem to agree on one thing: now is the time for Congress to insist upon risk-based portfolio margining for securities and security futures products so that America’s financial markets can have the risk management tools they need to remain competitive in the global financial marketplace.

In the futures markets, risk-based portfolio margining has been the standard for decades. A risk-based margining system sets margin levels based upon the historical performance and expected volatility of individual contracts, with the amount of margin designed to cover the expected one-day price change with an established level of statistical confidence (generally 99%). The one-day price change is an appropriate gauge because futures positions – including security futures – are marked to market at least once daily. A portfolio margining system establishes margin levels by assessing the net market risk for a portfolio of positions. This style of margining is based upon the premise that combinations of positions can have offsetting risk characteristics due to historical or expected correlations in their price movements. Just as individuals diversify their investments across asset classes to lower risk, firms can do the same using portfolio margining. Taken together, risk-based portfolio margining evaluates the economic risks of open positions with considerable precision, thus minimizing the chance of over-margining or under-margining, neither of which is optimal for capital efficiency, market liquidity, or risk management.

The issue of margin methodologies came into the legislative spotlight in 2000, when Congress enacted the CFMA. For nearly 20 years, until the CFMA was passed, the trading of futures contracts on single stocks and narrow-based stock indices was statutorily prohibited. When the ban was finally lifted, however, it turned out that the price for the futures industry was high, and the prospects for a robust market uncertain.

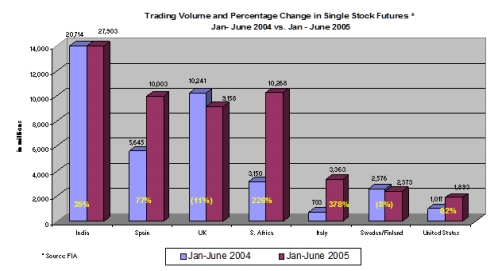

The price tag for security futures was a joint regulatory framework administered by the CFTC and the SEC, and a margining regime that imposed securities-style margining on contracts that function as futures. Ironically, one of the primary reasons security futures had been sought was the more precisely calibrated futures-style margining that would make them a cost-effective hedging tool. Employing securities-style margining has no doubt contributed significantly to the fact that, despite great anticipation, trading volume in these products in the U.S. remains low. This is compared to Europe, where security futures products have enjoyed remarkable growth using risk-based portfolio margining.

The CFMA required that margin rules for security futures be consistent with those for comparable options, and that margin levels not be lower than the lowest level of margin, exclusive of premium, required for any comparable option. This meant that, unlike all other futures contracts traded in the U.S., security futures could not be margined using a risk-based portfolio margining system – at least not until the same treatment was accorded to equity options.

After protracted negotiations between the CFTC and the SEC, margin for security futures was set at 20 percent of the current market value of the underlying stock or stock index, with the amount of margin reduced only for a very limited number of specific, enumerated combinations of offsetting positions present in an account. Referred to as fixed-rate, strategy-based margining, this approach is consistent with the approach used for equity options. The problem with this style of margining is that it is more readily susceptible to over-margining or under-margining, because it does not adequately factor in market risk.

While this requirement – intended to preserve competition by establishing a so-called level playing field for equity options and security futures – gave the appearance of fairness, in reality, it has stymied growth. The time has now come for the futures, options and securities markets to keep pace with the rest of the world and adopt risk-based portfolio margining across the board.

The benefits of risk-based portfolio margining are well known and are supported not only by the securities and futures industries, but also by the Federal Reserve Board. In fact, the Fed was clear in its endorsement of this approach when it delegated responsibility for prescribing security futures margin rules to the CFTC and the SEC. In its March 6, 2001 delegation letter, the Federal Reserve noted that, “the Board anticipates that the creation of security futures products will provide another opportunity to develop more risk-sensitive, portfolio-based approaches for all securities, including security options and security futures products.”

In 1986, the SEC approved risk-based portfolio margining for securities products at the clearing (not customer) level. Thus, it is not an unknown concept that draws us into uncharted waters. Currently, there are three different legislative proposals circulating that would serve to implement risk-based portfolio margining for security futures. Whether Congress ultimately chooses one of these paths or another that is yet to surface, I believe that Congress should choose a direct path and take an aggressive stand on modernizing U.S. financial markets. Recently, the Senate Banking Committee heard testimony on the issue of security futures margining and instructed members of the President’s Working Group on Financial Markets (PWG) to address this matter and present a consensus legislative package to the Committee. I am pleased by this development and encourage swift action by the PWG.

Since futures contracts on broad-based stock indexes (such as the S&P 500) began trading in 1982, they have enjoyed considerable success. More recently, markets for SFPs in London and Milan have experienced rapid growth and Madrid continues to enjoy high trading volume. If the U.S. security futures markets are going to survive, their development cannot be hampered by continued unwarranted restraints. By moving these markets in a global direction we can simultaneously foster competition and make our capital markets more efficient.

Disclaimer: The opinions expressed in this article are solely those of the author, and are not intended in any way to represent the views of the Commission.