Statement of Walter Lukken

Commissioner

U.S. Commodity Futures Trading Commission

to the FOW Trade Mission –Shanghai

November 21, 2003

�

I am honored to represent the U.S. Commodity Futures Trading Commission (CFTC) before this distinguished international group. I offer you greetings from the Chairman of our agency, James Newsome, who was not able to attend today. The CFTC, which is about to celebrate its thirtieth year of existence, is an independent federal agency based in Washington, D.C. that oversees the futures markets in the United States. The Commission’s mission is twofold: to foster transparent, competitive, and financially sound commodity futures markets that operate free from manipulation or distortion, and to protect users of those markets from fraud and other abusive practices.

I am one of five Commissioners, each nominated by the President and confirmed by the Senate, who make up the multiparty leadership of this agency. When Congress created the CFTC in 1974, U.S. legislators provided both Republicans and Democrats a role in the decision-making of the agency in an effort to consider the various views of the public. This model also fostered public confidence in the oversight process, as it was perceived that decisions were reached in a fair and balanced manner. During my first 15 months as a commissioner, I have been pleased to witness this bipartisan leadership producing just results for the public and the marketplace.

Today’s event is a noteworthy reminder that we live in a truly global economy. China is poised to be a major player in the world market for years to come. In large part, this is due to the significant strides made by the Chinese government since 1979 in implementing market structure reforms. As a result, your nation’s growth nears 10 percent, output has quadrupled over the last two decades, and standards of living have increased significantly. But some impediments remain in place in China that hinder the free and efficient flow of capital investment. U.S. Treasury Secretary John Snow and other U.S. representatives have been in discussions with Chinese officials regarding the proper valuation of the Chinese currency and its impact on trade. I understand that these talks have been productive and have brought about a more thorough understanding of both sides’ positions. Should the Chinese government choose to continue its 25-year progression toward free market principles and decide to remove some of the remaining economic impediments, including loosening currency controls, I strongly believe that futures and derivatives exchanges, such as the three Chinese exchanges now in operation, would prove to be an efficient and effective means for managing the risks and volatility that might result from such reform.

The development of the U.S. futures exchanges and their regulation over the last 150 years may offer some insights to those involved with the evolution of these markets in China. Based on my background and study of our market history, I have drawn some broad conclusions. First, derivatives markets demand a predictable, unambiguous legal system that serves as the basis for the creation and enforcement of these legal instruments. This means a nation’s laws —whether contract, bankruptcy or derivatives statutes — must be clearly crafted to allow for the proper functioning of such private instruments without hindering market discipline, demand and innovation. In addition, the regulatory structure for futures and derivatives trading must be flexible and tailored to the marketplace in order for regulators to keep pace with but not unnecessarily stifle market innovation.

Despite the fact that financial futures now dominate the U.S. landscape, the history of the futures markets in the United States is rooted in agriculture. To this day, the CFTC’s oversight bodies in Congress are the Committees on Agriculture in both the Senate and House of Representatives. The first U.S. futures exchange, the Chicago Board of Trade (CBOT), was formed in 1848 by local grain merchants who desired to even out price spikes and dips caused by seasonal gluts and shortages in agricultural commodities. This cash commodity market gradually developed into the trading of standardized “futures” contracts that could be used to transfer and manage price risk beyond the immediate growing season. The first U.S. futures contracts included wheat, corn and oats, which are still traded to this day in Chicago.

The first futures exchanges began, developed and grew largely without federal government involvement until the 1920s. There were several scandals on exchanges caused by excessive speculative behavior, leading to a public demand for greater regulation. In 1922, Congress enacted the Grain Futures Act, which was the first federal regulation of futures trading in the United States. The stock market crash of 1929 triggered a further outcry for regulation of all equity and commodities markets in the U.S., leading Congress to enact the Commodity Exchange Act (CEA) of 1936. Despite the occasional scandal and resulting legislative fix, the agriculture-based U.S. futures business did not change significantly over the next several decades.

The early 1970s witnessed a revolution in the derivatives industry. In 1971, President Nixon removed the U.S. from the Gold Standard, causing the U.S. dollar to float in relation to other currencies. The leadership of the Chicago futures exchanges understood that other types of commodities, including financial commodities, could benefit from futures trading.

The Chicago Mercantile Exchange (CME) ventured into financial products first, establishing the International Monetary Market (IMM) in 1972 to trade foreign currency futures. The IMM has been described as an example of the adage, “Necessity is the mother of invention,” as it filled an important commercial need in the world of floating exchange rates. Today, the CME conducts markets for twelve national currencies and the Euro, and also offers a dollar index based on a basket of seven currencies.

During that same period in the early 1970s, interest rates were very volatile, and the Chicago markets expanded their financial offerings to address this challenge. The CBOT introduced contracts on government-backed mortgage certificates in 1975, and two years later began trading futures on long-term federal government debt instruments. The IMM in 1981 launched its Eurodollar contract to shift risk associated with short-term interest rates. As we will see in a moment, these interest rate futures markets are now the biggest contributors to volume at the Chicago exchanges.

Equity futures are another major source of financial futures trading activity in the U.S. Several contracts have been initiated since the early 1980s on indexes such as the Value Line Index at the Kansas City Board of Trade, the Standard & Poor’s S&P 500 at the CME, and the Dow Jones Industrial Average at the CBOT. Just over a year ago, two new electronic exchanges – NQLX and OneChicago – began trading futures on individual stocks and narrowly based stock indexes.

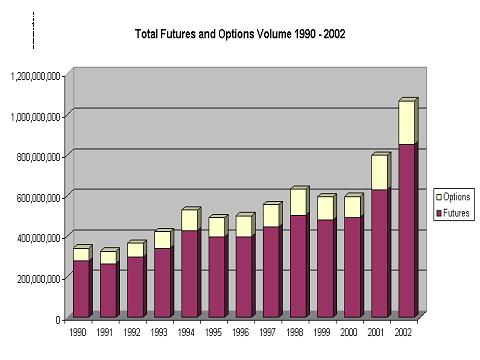

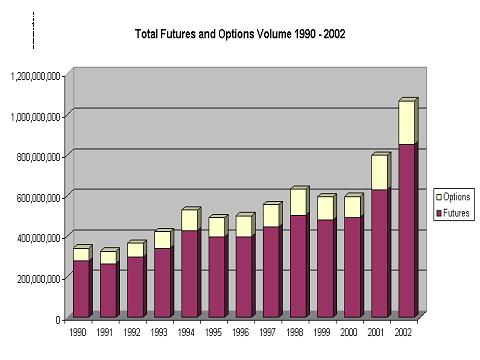

Financial futures and options trading have contributed to spectacular growth in the U.S. futures industry in the past decade.

In fact, total futures and options trading volume has more than doubled since 1994, and exceeded one billion contracts last year. As a regulator of these markets, it is noteworthy that in that same time period, the staffing at our agency has held essentially steady at approximately 500 employees. With this challenge in mind, I am very proud of our staff and the jobs they do in overseeing these markets.

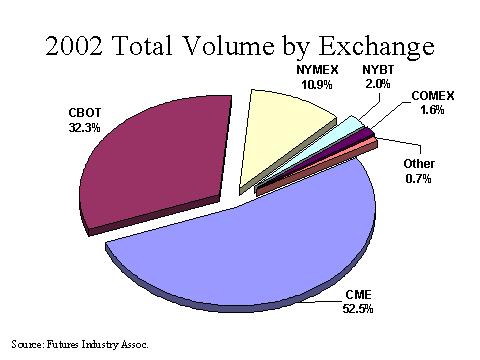

Looking at the breakout of business by exchange, it is clear that Chicago, the birthplace of the futures industry in our nation, continues to be the capital of the industry. The two major Chicago exchanges have almost 85 percent of total volume – the CME with about 53 percent and the CBOT with about 32 percent. The New York Mercantile Exchange, home of several important energy and metals contracts, is third in volume with approximately 11 percent of the total.

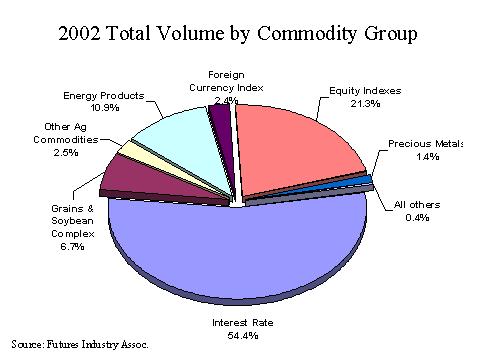

As I alluded to earlier, non-agricultural trading has grown tremendously and now represents the vast majority of futures and options volume on U.S. exchanges. Interest rate contracts alone have over 54 percent of the volume and equity indexes have about 21 percent. Energy products account for almost 11 percent of the trade. Total agricultural volume is 9.2 percent of the overall, with grains and soybeans comprising 6.7 percent.

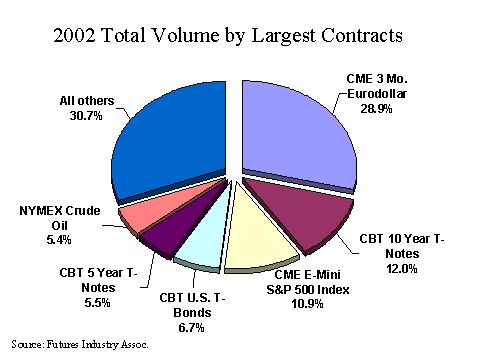

Of the contracts themselves, the Eurodollar at the CME is the most-traded in the U.S., with almost 29 percent of all futures and options volume. The CBOT’s “Treasury complex” based on government debt instruments comprises a total of just over 24 percent. The most popular of the equity-based contracts is a small version of the CME’s S&P 500 Index, with almost 11 percent of total volume.

In sum, the futures markets in the U.S. are thriving, with exchanges constantly working to offer products that enable users to efficiently mitigate the risks in this increasingly global economy. It is this attention to customer demand and the ability to innovate to meet this demand that has led to such growth. But market success cannot exist without the proper laws and regulations that protect property rights, enable the enforcement of contractual agreements and minimize fraud and manipulation of these markets.

Futures and derivatives markets require a clear and predictable legal and regulatory system if they are to thrive, and the U.S is fortunate to benefit from such a foundation. On December 21, 2000, U.S. President Bill Clinton signed into law the Commodity Futures Modernization Act (CFMA). This bipartisan legislation was the most sweeping overhaul of the laws governing the commodity futures markets since the creation of our Commission in 1974. The Act’s broad design sought to bring greater competition, self-regulation and innovation to the various derivatives markets and to build a more predictable and calibrated regulatory apparatus for these instruments.

One of the principle motives behind this legislation was to clarify the legal status of the U.S. over-the-counter (OTC) derivatives market, which had become clouded over the years. When amended in 1974, the CEA required that the trading of all commodity futures contracts occur on a registered futures exchange under the exclusive jurisdiction of the CFTC. This regulatory structure was designed for the traditional “open outcry” or pit-trading exchanges to ensure that standardized futures trading occurred in specific physical locations under the watchful eye of a federal regulator. This regimented oversight also took aim at off-exchange “bucket shops,” in which individuals would fraudulently solicit funds from customers for futures trading and then pocket or “bucket” the money for themselves. Requiring that futures trading occur on a registered exchange among registered brokers under the CFTC’s exclusive jurisdiction was seen as revolutionary at the time and greatly minimized this illegal activity.

This regulatory model, however, was ill-fitted for legitimate financial instruments that traded off-exchange, including the developing OTC derivatives market. It is true that the economic functions of OTC derivatives are similar to futures contracts. Both seek to transfer undesired economic risk from one party to another willing to accept it. Unlike standardized futures contracts, however, OTC derivatives are not traded on registered futures exchanges but are tailored transactions designed and brokered for sophisticated counterparties through regulated banking institutions.

In 1998, the CFTC began to take steps suggesting the agency was on a path to regulating OTC derivatives at the expense of other Federal regulators. This change of regulatory direction was disconcerting to the markets, given the fact that the CFTC had chosen not to regulate these transactions since 1993. Beyond this jurisdictional question lay a more problematic systemic issue. Market participants feared that if the CFTC asserted its exclusive jurisdiction over OTC derivatives, these transactions could be deemed illegal off-exchange futures contracts under the CEA, allowing a court of law to declare the contracts null and void. Such a ruling could have reverberated throughout the entire OTC derivatives market by allowing parties to walk away from unprofitable OTC derivative obligations. It became imperative that the legal and jurisdictional cloud surrounding these transactions be dissipated to keep this marketplace thriving and onshore.

In November 1999, the President’s Working Group on Financial Markets (PWG), which consisted at the time of Federal Reserve Board Chairman Alan Greenspan, Treasury Secretary Laurence Summers, Securities and Exchange Commission Chairman Arthur Levitt and CFTC Chairman William Rainer, unanimously proposed to Congress clarifying the jurisdiction of the CFTC by excluding certain OTC derivatives from its oversight. In determining whether the CFTC should have regulatory authority, the PWG looked to whether the products were traded by retail customers, whether the products were susceptible to price manipulation and whether the participants were not otherwise regulated. Unless one or more of these attributes were present in these markets, the PWG believed that there was no policy justification for providing the CFTC with oversight. Congress ultimately incorporated this reasoning in the CFMA by including several different exclusions that removed these products from the CFTC’s jurisdiction.

The CFMA also provided a new flexible regulatory structure for the futures exchanges. The law laid out differing tiers of regulation for exchanges, depending on the types of products traded and the level of sophistication of the participants trading them. Futures on commodities that are more susceptible to manipulation and are offered to the retail public, such as agricultural futures contracts, are more heavily regulated. Those instruments that are less vulnerable to manipulation and are offered only to sophisticated investors and institutions would benefit from a lighter regulatory touch. The intent behind the tiered regulatory structure was to allow exchanges to innovate more rapidly to meet competitive challenges while enabling the CFTC to tailor its regulatory focus to those areas requiring greater government scrutiny.

Furthermore, the CFMA transitioned the regulatory structure of the CFTC from prescriptive rules and regulations to one using a principles-based approach. Instead of specifying the means for achieving a specific statutory mandate, the CFMA set forth core principles that are meant to allow participants in these markets to use different methodologies in achieving statutory requirements.

In fleshing out these core principles, the law allowed the Commission to issue “best practice” regulations for complying with the core principles or allowed the CFTC to approve such acceptable business practices. Allowing the industry and self-regulatory organizations, rather than the CFTC, to develop their own standards and guidelines was thought to better promote the practices reflective of the marketplace. The CFTC ultimately retains the authority to approve such practices, but the genesis for such guidelines is derived from the marketplace rather than the traditional top-down regulatory structure.

The CFMA provided exchanges with authority to approve new products and rules without CFTC involvement through a self-certification process. In self-certifying a new rule or product, the exchanges must provide the CFTC with a written declaration that the new contract or rule complies with the Act and its regulations. The CFMA also reserved for exchanges the option to request CFTC approval of a new rule or contract prior to becoming effective. These changes were seen as necessary to allow exchanges the ability to react quickly to the competitive challenges anticipated by the Act.

I strongly believe the CFMA has provided this marketplace with a more predictable and reasoned legal and regulatory structure. The derivatives markets have continued to grow exponentially since its enactment. Indeed, the notional value of outstanding OTC derivatives contracts has grown by almost 50 percent since its passage in December 2000. Federal Reserve Chairman Greenspan credits the expanded use of derivative instruments with the enhanced resilience of U.S. financial institutions and economy in general. Mr. Greenspan believes that the use of derivatives has helped to minimize the severity and length of the latest U.S. recession by spreading the concentration of market risks among a much larger group in the economy. By fixing the once-shaky legal foundation upon which derivatives contracts are based, the CFMA has ensured that these financial instruments would continue to serve an important economic function in the U.S. financial system.

As Congress anticipated, the regulatory reform provisions of the Act have contributed to greater competition among futures exchanges. Prior to the enactment of the CFMA, there were 12 registered futures exchanges in the United States, and a majority of these exchanges had been in existence since the 19th century. Since the CFMA, the CFTC has designated four additional futures exchanges, and another three exchanges that are trading futures contracts as exempt markets subject to limited CFTC oversight. In addition, the CFTC is now considering the application of Eurex, the world’s largest futures exchange, to operate a registered futures exchange in the U.S. that will compete directly with the Chicago exchanges. These numbers indicate that the barriers to entry for exchanges have been significantly lowered by the CFMA, and opportunities exist for enhanced competition to thrive in these markets. Laws cannot guarantee competition but they can be tailored to maximize competitive opportunities. At a minimum, the CFMA has done just that.

This conference is evidence that China and its exchanges are exploring additional opportunities in the global economy. With the significant demand by Chinese commercial interests for agricultural, energy and financial commodities, the fundamentals exist to support a robust futures business in China. In fact, I understand that the Shanghai Futures Exchange and the Chicago Mercantile Exchange have reached an agreement regarding technical assistance, information sharing and product development. I also want to offer our agency’s assistance as your government refines its regulatory framework dealing with futures markets. I am confident that our nations and markets will mutually benefit from the shared experiences of market participants and regulators in forums such as this and through ongoing dialog. I appreciate the opportunity to address your illustrious group.