Remarks of CFTC Commissioner Walt Lukken

Futures and Derivatives Committee

The New York State Bar Association

May 20, 2003

Good afternoon. I am very pleased to join you for lunch today. I am also pleased to be with my colleague, Commissioner Brown-Hruska, for this session. As you have heard, Sharon brings a valuable economic perspective to the Commission that I sincerely appreciate. As a lawyer and former Senate staff member, I bring a different set of skills and views to the agency. Nevertheless, Sharon’s background as an economist challenges the rigor of our thinking, and I am delighted to be her colleague and friend.

It has been almost nine months since I was sworn in as a Commissioner of the Commodity Futures Trading Commission and it has been an exciting and challenging time. I came to the Commission from the staff of Senator Richard Lugar on the Senate Agriculture Committee. I am a native of Indiana and studied finance at the Kelly School of Business at Indiana University. I then went on to receive my law degree from Lewis and Clark College in Portland, Oregon. In 1993, I began my career with Senator Lugar in his personal office, handling various financial and tax policy issues.

As you can well imagine, it was a great honor to have Senator Lugar as a mentor. It is reassuring that a man of such integrity and fairness is chairman of the Foreign Relations Committee at such a critical time for our country and the world.

In 1997, I began to cover issues relating to the futures and derivatives markets for Senator Lugar on the Agriculture Committee. In this capacity, I staffed the passage of the Commodity Futures Modernization Act of 2000 (CFMA), legislation that reauthorized the CFTC and significantly reformed the law and approach to regulating these markets. My work in advancing this legislation involved engaging staff, both Republicans and Democrats, as well as industry members and regulators in an attempt to build a consensus among them. I believe that this “open door” approach left those involved with this legislation – even those opposed to it – with the belief that the final product was developed in a fair manner. I continue to adhere to this style at the CFTC today.

Since joining the Commission, it has been a busy time -- and that was before I became a father. In fact, this is my first “road trip” since my son, Will, was born on April 18th. Tonight will be one of the best nights of sleep that I’ve enjoyed in a while. I’m sure my wife, Dana, will be jealous.

I’d like to talk briefly about my regulatory philosophy and about some of the specific areas that have been keeping us busy at CFTC since I arrived. I adhere to a regulatory approach that has been termed “smart regulation.” It is the concept that regulators must tailor their oversight to meet the public mission without adding excessive burdens to market participants, including consumers.

With this philosophy in mind, several regulatory issues are worth discussing at greater length today. I have been tasked by Chairman Jim Newsome to take the lead role for our Commission in working with the Securities and Exchange Commission to complete our implementation of the CFMA. I have met with Commissioner Paul Atkins and other SEC Commissioners over the past several weeks, and I am looking forward to a fruitful working relationship ahead.

Currently in play is a memorandum of understanding between CFTC and SEC involving the nuts and bolts of our joint oversight of security futures product (SFP) trading on domestic exchanges. That includes the proper sharing of information that our agencies accumulate on a regular basis from these markets as well as the appropriate conducting of audits and examinations of exchanges and firms. During the behind-the-scenes discussions on the CFMA, lawmakers were very clear that they did not want a regulatory structure for security futures products that led to double regulation of these instruments. This memorandum is intended to be a document that will ensure there is not duplicative oversight.

We have also recently worked out with the SEC an interim protocol on speculative limits for narrow-based SFP indices. That was an area in which Commissioner Brown-Hruska was especially interested and provided valuable input.

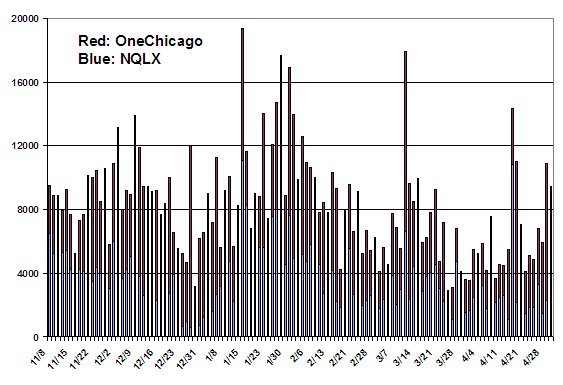

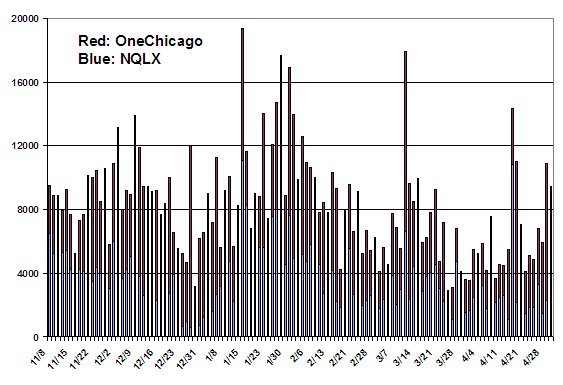

As you are aware, the two U.S. exchanges for SFPs, NasdaqLiffe and OneChicago, began trading the products last November. We at the Commission have been watching those markets with great interest as they grow.

In terms of total daily volume for SFPs, the general trend was upward until about early February, when it began to slowly decline.

Since early April, though, the trend line has had a positive slope. And on May 5, a new single-day total volume record of 20,789 contracts was set (OneChicago had 16,962 of the total, which was also a daily high for that exchange alone).

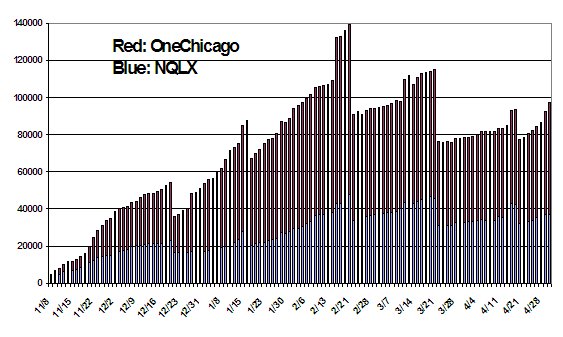

The open interest trend has also been uneven. It grew quite steadily from the first trading day to a peak of about 140,000 contracts in mid-February.

However, the growth rate in open interest flattened in March and April. You can see the final few trading sessions depicted on the chart saw acceleration, and in fact open interest as of last Friday was almost 133,000 contracts. OneChicago currently holds about a two-to-one lead in open interest, but the split between it and NQLX has been comparable overall.

History suggests it is difficult to predict the long-term success or failure of futures contracts in the early days of their trading. However, it is worth noting that the volume on the SFP markets in the first six months of their operation is substantially greater than the initial half-year of trading for Eurodollar, T-Bond and crude oil futures. As Chairman Newsome has pointed out, total SFP volume at both the new exchanges was also significantly greater than the volume of stock option trading during the corresponding launch months on the Chicago Board Options Exchange.

The jury of the marketplace is still out regarding SFPs. However, it is my belief that these are potentially quite useful products that can be used both by retail customers and larger entities to hedge their risk of holding equities. The initial performance of the SFP contracts in the current equities market environment may not be indicative of their longer-term usefulness. At any rate, the success or failure of SFPs should be a function of the marketplace, not regulation. In the crafting of the CFMA and its implementation, policy makers were mindful that the regulations should not favor one market over another and that regulation should not be so burdensome as to harm the chances of the markets’ success.

There is still important work to be done by the CFTC and SEC on the SFP front. In the CFMA, Congress instructed the two agencies to write joint rules for the trading of foreign narrow- and broad-based security futures products. Although the deadline of December 21, 2001 for completing rules on foreign broad-based products has passed and no deadline is contained in the Act for completing the foreign narrow-based rule, I am confident that Congress intended these rules to be contemporaneous with the recent launching of the domestic trading of these products. I am hopeful that SEC Chairman William Donaldson will, amid the other challenges he faces, make this foreign SFP issue a priority.

The smart regulation concept also should apply to another timely issue that regulators in Washington are considering, which is the proper oversight structure for the hedge fund industry.

The Commodity Exchange Act currently requires managers of investment vehicles that trade even a single futures contract to register with the Commission as a Commodity Pool Operator (CPO). This is in contrast to the securities laws that provide certain exemptions for hedge funds if participants in the fund are limited to sophisticated investors.

Last summer, staff of the CFTC held a roundtable to discuss the current regulatory structure for CPOs and have come forward with some recommendations to the Commission. In March, the CFTC put out for comment a set of proposals that would expand existing exemptions and add new exemptions for CPOs and commodity trading advisers (CTAs).

The CFTC’s proposal discusses exempting from registration so-called “accredited investors” that only trade a limited amount of futures as a part of a fund. The proposed threshold would be either that margins and premiums from commodity interest positions not exceed two percent of liquidation value, or that the aggregate net notional value of commodity interest positions does not exceed 50 percent of liquidation value. “Accredited investor” is a term in SEC regulations and refers to individual people with at least $200,000 in annual income or a net worth of $1 million or more.

The proposal also discusses exempting from registration, regardless of the amount of the pool’s commodity interest trading, should the funds only contain large, sophisticated investors, similar to the SEC’s current exemption. These so-called “Qualified Eligible Persons” include individuals with at least $5 million in investments.

Under this proposal, the CFTC does not cede its jurisdiction over these funds and retains its fraud and manipulation authorities over these entities. Furthermore, the Commission will indirectly maintain a relationship to these funds through our regulation of FCMs that carry the futures accounts of these investment vehicles. In addition, the FCMs will continue to conduct their due diligence of such funds when doing business with them.

The comment period has ended for this proposal and our agency received 31 comments. The Commission is now carefully reviewing these comments. Because of the status of these plans, it is not appropriate for me to comment on them further.

In addition to our review of CFTC regulations on commodity pool operators and commodity trading advisers, the SEC last week held a two-day roundtable on hedge funds, which included participation from members of the industry, investors, and regulators, including the CFTC. I attended most of these discussions and found the dialogue extremely educational. Due to our agency’s proposal, I wanted to carefully listen to these discussions to get a better feel for the risks posed by this industry as well as the views of my fellow Commissioners at the SEC. In fact, I spoke with Chairman Donaldson at the roundtable to express my hope that our two agencies would coordinate our efforts and information sharing on this issue.

My general observation from the event was that there is a growing mood in Washington to re-evaluate the regulatory structure of hedge funds. In light of the CFTC’s efforts and the SEC’s discussions in this area, it is important for regulators and policy makers to consider the following matters brought to light during the roundtable:

First, I believe the perceived problems surrounding the hedge fund industry need to be more clearly defined. There appeared to be a lot of blurring of the issues during the two days. It is not clear to me whether the primary concerns with these investment vehicles relate to customer protection issues and access by retail investors, the need for greater transparency of these funds to strengthen market discipline or systemic risk concerns that derive from the experience of Long Term Capital Management. Before seeking a tailored solution, it is extremely important for regulators and policy makers to properly define the scope of the problem.

My second observation is that the class of investment vehicles that fall within the term “hedge fund” is enormous. Broadly speaking, the term “hedge fund” refers to large institutional investment vehicles that are mostly unregistered with the SEC by virtue of confining their access to sophisticated investors. However, during the roundtable’s discussion on enforcement issues, panelists from both the SEC and CFTC were incorporating into the hedge fund discussion individuals who commit fraud by marketing themselves as hedge fund managers and bucketing the profits for themselves. In my view, these people are fraudsters and have little to do with the concerns surrounding the legitimate hedge fund industry. These fraudulent individuals use the term “hedge fund” as a hook to illegally solicit funds from the public. From a regulatory standpoint, this behavior is not a hedge fund problem, per se – it is essentially an issue of fraud. Three years ago these same charlatans were pitching investments in biotech or Internet stocks. Currently, the SEC and the CFTC have adequate fraud authorities to aggressively go after this type of behavior. It is important that the concerns that flow from legitimate hedge funds do not get lumped in with the fraudulent individuals who claim to be operating hedge funds in name only.

Lastly, I believe it is important that regulators coordinate their efforts in this area. On this issue, our agencies have the common goals of investor protection and minimizing systemic risks in our markets. It makes sense that we work hand in hand together as we go forward to meet these public missions. For example, one of our agency’s proposals references the term “accredited investor” from the securities laws. If the SEC is going to adjust this definition in some way, it is going to have an impact on our regulations. As a Commissioner, it is my sworn duty to make decisions in the public interest based on the best information available. That is why I believe it is important that the SEC and CFTC coordinate their efforts to ensure that the regulatory structure surrounding this sector is appropriate and without redundancies or gaps. This goes to the heart of the “smart regulation” framework that I have referenced earlier.

Even as we work to develop oversight regimes for SFPs and update our rules regarding commodity pools and commodity trading advisers, the CFTC’s investigative and enforcement activities move ahead across the breadth of markets we are charged to oversee. We at the CFTC are committed to upholding the integrity, efficiency and reliability of these markets, and I am pleased to note that our enforcement division has been diligent in carrying out these mandates. For example, since the CFMA clarified our Commission’s authority over illegal off-exchange retail foreign currency operations, our enforcement staff has used that authority to initiate more than two-dozen formal actions.

In the energy sector, the Commission last December imposed a $5 million civil monetary penalty against Dynegy and West Coast Power in connection with false reporting and attempted manipulation. In March, CFTC filed a three-count complaint against Enron in Federal court in Houston, including charges that Enron manipulated Henry Hub natural gas prices and operated an illegal futures exchange. That same month, El Paso Merchant Energy entered into a consent order that penalizes the firm $20 million for the reporting of false information to energy price reporting entities. In addition to these cases, our enforcement division is actively engaged in more than 20 other energy sector investigations, which may result in further charges being filed.

Allegations of manipulation in energy markets have also spawned extensive criticism in Congress. This is turning out to be a significant issue in the debate over comprehensive energy legislation in the House of Representatives and the Senate, and has the potential to affect our responsibilities at CFTC. I would like to shift gears and give an overview of the state of play of this legislation. Commissioner Brown-Hruska, as the person tasked by our Chairman to take a lead on these energy issues for our agency, has already touched on these issues today and she makes several valid points. However, my background with the writing of the CFMA provides me with a unique view of this issue, which I would like to share with you as well.

As you are aware, the CFMA exempted over-the-counter energy and metal derivatives from CFTC oversight, except that it provided the CFTC with anti-fraud and anti-manipulation authorities over products traded on bilateral markets and provided additional regulatory authorities over these products when traded on a multilateral exchange. Congress provided CFTC with limited authorities in the energy area because these were commercial markets – thought to be deep and liquid – that had operated pursuant to an a CFTC administrative exemption since 1993.

Subsequent events, including the collapse of Enron, have attracted public attention to the business of energy trading and the laws that govern it. Investigations by regulators have uncovered the prevalent practice of “wash trading” by energy firms that have allegedly made these transactions without economic justification. There have also been the enforcement actions on alleged false reporting and manipulation that I mentioned a moment ago. The widespread nature of these charges has harmed the entire energy-trading sector. Once-active trading desks at many energy companies have all but shut down. At the same time, we have witnessed the dramatic devaluation of energy stocks due to a combination of credit problems, low trading volume, and falling investor confidence.

There are concerns among industry participants that Congress may overreact to the energy market situation with legislation that is overly burdensome and prescriptive. I agree that we must be cautious about imposing broad new oversight of these markets, which could repel reputable parties from trading energy derivatives that provide benefits to consumers. But I do believe that some carefully targeted new regulatory involvement would actually benefit these markets – not only to deter illicit behavior, but also to bring participants back into the trading realm. Congress may want to consider new authorities for federal regulators to levy more substantial monetary penalties for fraud and manipulation of energy markets. In addition, our enforcement abilities can be made even more robust through enhanced recordkeeping requirements that allow us to recreate audit trails and by the strict prohibition of wash trades that have price effects on futures markets.

Congress should ask the following questions of any legislative proposal to oversee energy derivatives. First, would market disciplines achieve the same or greater benefits at a smaller societal cost? If not, will additional government regulation actually add value? And, are we assigning the right regulator to the task, or do we risk compromising the oversight of other markets that are clearly within the current regulatory structure? Already, the energy markets have adjusted to these problems, adopting industry best practices on energy trading and seeking to avoid credit shortfalls through the use of clearing. The challenge for policy makers is to decide whether more improvements must be mandated by the government.

I can report to you that the Senate, at least, will apparently have some more time to ponder those questions. The energy bill that was brought up earlier this month has been sidetracked for the time being due to several contentious amendments, including an energy derivatives proposal. Key staff sources have suggested that it may be summer before the omnibus bill is brought back up in the Senate. The delay may also limit the window of opportunity for completing the legislative process if the bill’s consideration is pushed into next year, as a number of observers in Washington give long odds on the enactment of a measure as broad and controversial as the energy bill in an election year.

I am hopeful that Congress will ultimately make the right determinations and that we will be able to implement a “smart regulatory” approach along the lines that I have talked about. President Bush’s departing budget director, Mitch Daniels, and the Administration’s “regulatory czar,” Dr. John Graham, use the term “smart regulation” to describe effectively meeting public goals without burdening individuals with unnecessary costs. The “smart regulation” approach does not necessarily mean more regulation or less regulation. There will be times when the evidence, analysis and public sentiment justify a greater regulatory involvement. When this is the case, I will support regulatory action. At other times, the opposite will be true. But in either event, regulators are obliged to weigh the costs to the public as well as the benefits of implementing regulations, and to do so in a timely, informed and open manner. I commit to you today that this will continue to be my decision-making model during my tenure at the CFTC.

Thank you again for the invitation to speak to your group.