Statement of Commissioner Walter Lukken

to the National Grain Trade Council at their Annual Meeting

February 7, 2003

Good morning, and thank you for the invitation to address your group. The National Grain Trade Council has always been an important voice in agriculture as well as the futures markets.

It has been almost six months since I was sworn in as a Commissioner of the Commodity Futures Trading Commission and it has been an exciting and challenging time. I’m still very much in the learning process and attending your meeting is an important part of that experience.

I came to the Commission from the staff of Senator Richard Lugar on the Senate Agriculture Committee. That experience allowed me to learn a lot about agriculture, especially since my educational background is more on the financial side. I studied finance at the Kelly School of Business at Indiana University, so I am more conversant regarding yield curves than crush margins. After graduating from Indiana, I went on to receive my law degree from Lewis and Clark College in Portland, Oregon. In 1993, I began my career with Senator Lugar in his personal office, handling various financial and tax policy issues.

Senator Lugar, who is now the ninth most senior member of the Senate and fourth among Republicans, is held in high esteem in that chamber. It was indeed a great honor to have a man of such fairness and integrity as a mentor. Although his leadership on the Agriculture Committee will be missed, I am reassured that he is now chairman of the Foreign Relations Committee at such a critical time for our country and the world.

In 1997, I began to cover issues relating to the futures and derivatives markets for Senator Lugar on the Agriculture Committee. In this capacity, I staffed the passage of the Commodity Futures Modernization Act of 2000 (CFMA), legislation that reauthorized the CFTC and significantly reformed the law and approach to regulating these markets. My work in advancing this legislation involved engaging staff, both Republicans and Democrats, as well as industry members and regulators in an attempt to build a consensus among them. I believe that this “open door” approach left those involved with this legislation – even those opposed to it – with the belief that the final product was developed in a fair manner. I continue to adhere to this style at the CFTC today.

I can report to you today that there are few issues exclusive to the grain industry occupying us at the Commission. I suspect this is due in part to the relative maturity of the grain futures markets. In addition, I imagine that the mix of issues we deal with at the CFTC is a function of the overall volume of trading on the futures exchanges, which has shifted from primarily agricultural to financial over some time.

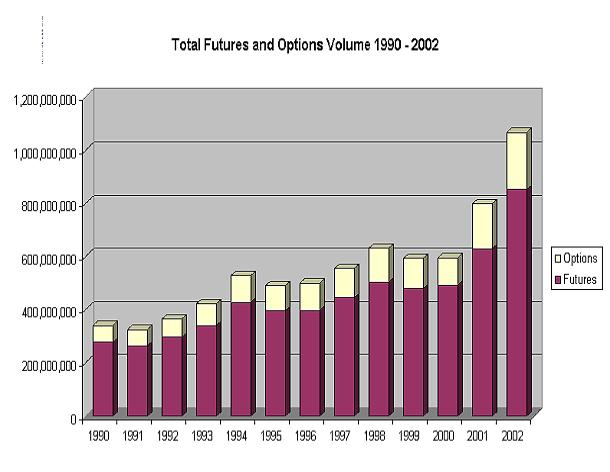

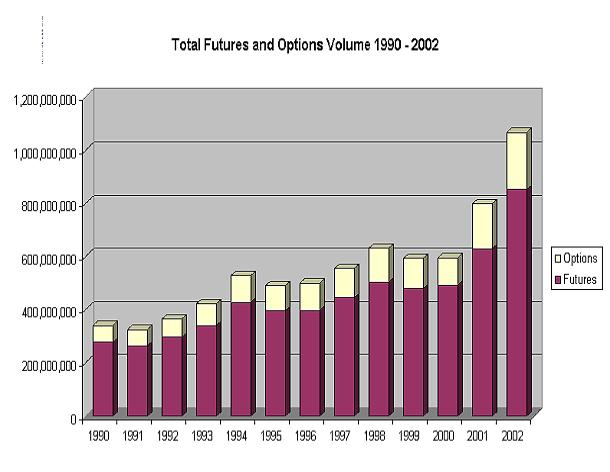

To help you appreciate the overall task we have at the Commission, I have brought a few graphs that depict activity in the futures and options markets through last year.

Yours is clearly a growing industry! Total futures and options volume on U.S. exchanges has doubled since 1994. It is noteworthy that in this period, CFTC staffing has held essentially steady at an average of approximately 540 “full-time equivalent” employees.

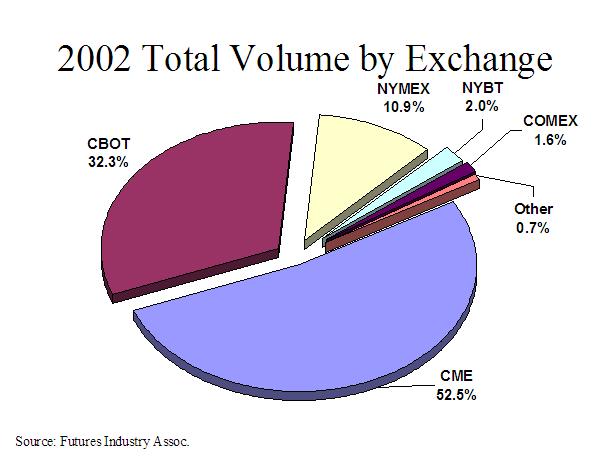

The Chicago exchanges dominate, with almost 85% of total volume. The New York Mercantile Exchange is next with approximately 11%.

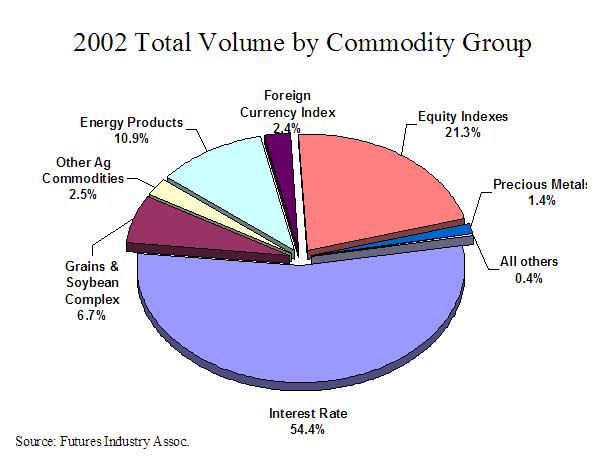

As I noted, non-agricultural trading represents the vast majority of futures and options volume. Total agriculture volume is 9.2% of the overall, with the grains and soybean complex comprising 6.7%.

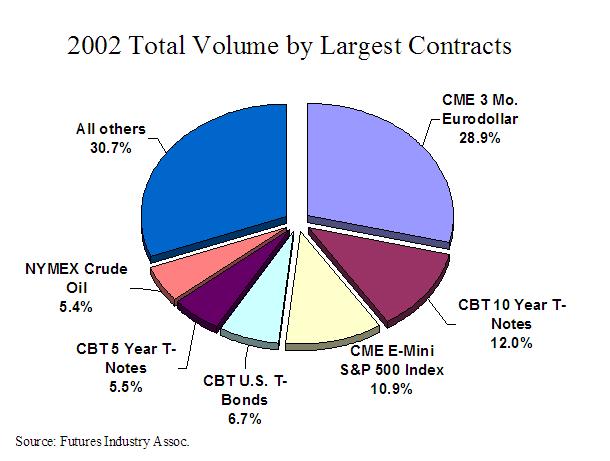

The Eurodollar contract at the Chicago Mercantile Exchange is the most-traded, followed by T-Notes, the S-and-P E-Mini and T-Bonds, all at the Chicago Board of Trade.

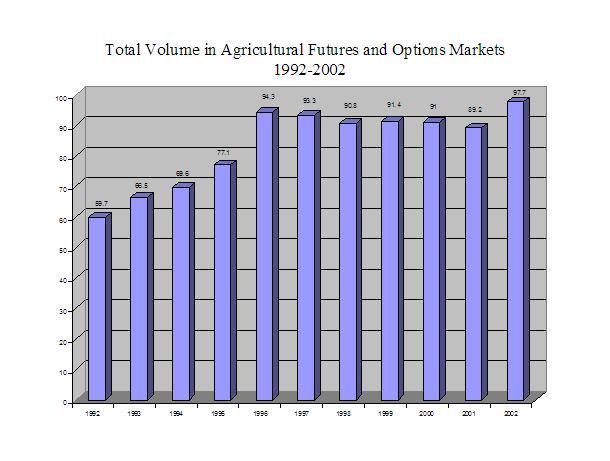

Agricultural product volume has been relatively steady since 1996. However, there was a sizable jump in volume last year of almost 8.5 million contracts.

All that having been said, I assure you that our staff at the Commission is very well

versed in the comings and goings of the grain markets, which are frequently featured

in the weekly surveillance briefings that Commissioners receive from our Division of

Market Oversight.

Since these contracts are important price discovery markets with a history of

attempted squeezes and corners, the time spent by the Commission overseeing these

agricultural markets is far in excess of their percentage of total futures and options

trading.

An example of our close attention to the agricultural markets came last year, involving the Live Cattle contract at the Chicago Mercantile Exchange. Last March, concerns were raised with the Commission that reports of foot and mouth disease in Kansas had artificially manipulated the price of the live cattle contract. Although a thorough investigation by the Commission staff indicated otherwise, the incident highlighted for many the need to re-evaluate the terms of this contract. Besides this incident, there had been other concerns within that market about the erratic convergence of futures and cash prices as nearby months reached expiration. The CME reported to the Commission that there were several potential factors for this situation but it concentrated on the shortage of cattle that met the contract’s delivery specifications. After considering the situation, the CME proposed reducing the position limits on a temporary basis while permanent changes to the contract terms were discussed. We at CFTC put out the proposal for public comment. After modifying the proposal to address some concerns raised in the comment period, the CME ultimately adopted the change and that contract month went off the board in what I understand was a relatively uneventful process. For several days, the Live Cattle contract was “priority one” for me and for the other Commissioners. Longer-term changes to the contract specifications have since been proposed by the CME and the CFTC comment period on the proposal ends today. So I think this is a good example of how we at the Commission try to stay attuned to the markets that are so important to your business.

Overall, as I said earlier, things are relatively tranquil on the regulatory front involving the grain futures markets. And I imagine that is just fine for most of you. To keep you up to date on a long-standing matter involving your industry, there are currently three cases regarding hedge-to-arrive contracts that have been appealed to the Commission. Obviously, I cannot discuss the specifics of these cases or how they might be ultimately disposed of. However, I can say that they are a high priority of the Commission and it is my hope that we can deal with them expeditiously. We realize that final adjudication of these cases is in the interest of the parties involved as well as the public in general.

After the Commission takes action on these cases, it may be appropriate for us to look at the general topic of risk management contracts for agricultural commodities. Such a discussion may lessen the ambiguity that currently exists in the wake of the hedge-to-arrive litigation. Farmers and ranchers benefit from a wide variety of risk-management tools, whether they involve products within our jurisdiction or not, and I feel the Commission can and should play a constructive role in facilitating discussion in this area. During my confirmation hearing before the Senate Agriculture Committee, I pledged to Chairman Harkin and Ranking Member Lugar that I would explore this issue once sworn in as a Commissioner. Chairman Jim Newsome and I have discussed the possibility of convening the Agricultural Advisory Committee at the appropriate time to solicit the opinions of groups such as yours on this topic. To lend a hand in this effort, I was appointed last week by the Commission to be Vice Chairman of the CFTC Agricultural Advisory Committee. Although Chairman Newsome will remain the Chairman of this important committee, my experience on the Senate Agriculture Committee and my general background on this issue may help advance this matter as well as other agricultural issues that may be before the Commission. I look forward to participating with Jim and the other Commissioners in those discussions.

Turning to the scene in Washington, there are several new congressional leaders who will play important roles in your industry. I say “new” in that they are assuming key assignments for the first time, but they are certainly no strangers to agriculture or to the CFTC.

We have new leadership on our authorizing committee in the House of Representatives. Bob Goodlatte of Virginia is the new Chairman of the Agriculture Committee, succeeding Larry Combest, who will retire from Congress in May. Chairman Goodlatte displayed interest in futures trading issues very shortly after learning he was in line to head up the committee. He met last November with Chairman Newsome and I also understand he has already visited with exchange officials in Chicago. Chairman Goodlatte stood firm to keep jurisdiction of both financial and agricultural futures in his committee and retain CFTC issues in the same subcommittee where they were handled in the past.

Representative Jerry Moran of Kansas now chairs that subcommittee on general farm commodities and risk management. Mr. Moran is known as a particularly engaged and bright member. People who watch our issues expect he will take a hands-on approach with legislative proposals in our area. It should be noted that both Representatives Moran and Goodlatte were members of the Agriculture Committee when the CFMA was passed in 2000, so they certainly had significant exposure to our legislation.

Across the Capitol, Senator Thad Cochran of Mississippi succeeds Senator Tom Harkin as chairman of the Senate Agriculture Committee. As you may know, CFTC Chairman Newsome is from Mississippi and he and Senator Cochran have been friends for many years. So I am confident that this relationship will bode well for the CFTC in the Senate.

Senator Cochran also will chair the Agriculture Appropriations subcommittee, which controls the funds provided to farm programs, the Department of Agriculture and the CFTC. I believe this is the first time this dual-chairmanship has occurred, making Senator Cochran an especially powerful voice on agricultural and futures issues.

Given his new chairmanship of the Foreign Relations Committee, I imagine Senator Lugar will be less involved in agricultural issues. An exception to this may be futures trading issues, with which Senator Lugar is well versed, given his leadership in writing of the Commodity Futures Modernization Act in 2000.

Indeed, this is an important time for our funding at the Commission. As you know, just this week the White House released the spending recommendations for fiscal year 2004, which begins this October. I am pleased to report that the budget includes an increase of about $8.5 million over this year’s suggested funding level for the CFTC. You also will be glad to hear that the increase will not come out of the pockets of this industry. The budget contains no recommendation for transaction fees for futures market participants.

The fiscal year 2004 budget request for CFTC, totaling $88.4 million, provides us with an extremely valuable new authority to help us perform our mission. It is known as “pay parity,” which will allow the CFTC to attract and retain talented individuals who are also highly sought-after in the private and public sectors. Currently, the CFTC has to compete in the job market with other federal financial regulators, such as the Securities and Exchange Commission and the Federal Reserve, that already have this flexible pay parity authority. I can’t overestimate the importance of this capability. For instance, in the last four years, CFTC has experienced an average annual turnover rate of almost 17% for attorneys.

In addition to next year’s budget, Congress continues to work on appropriations bills for the current fiscal year, 2003. As you may know, much of the government is operating on what’s called a “continuing resolution” that essentially holds spending for agencies, including CFTC, at the same level as in fiscal year 2002, which expired last September. The Senate has passed a spending measure that would provide CFTC with about $94 million in the current year, while the House version of the same bill contains about $80 million for the Commission. The staffs of the House and Senate subcommittees that handle the Agricultural Appropriations bill, which also funds CFTC, are trying to work out the various differences in the two versions and we are certainly hopeful that they are able to reach a compromise that will allow us to at least start implementing pay parity in the current fiscal year.

Looking at the challenges ahead, the ongoing implementation of the Commodity Futures Modernization Act will continue to be an important task in the coming year. The overwhelming motivation behind this legislation was to resolve the “legal certainty” problem that had plagued the over-the-counter derivatives market for years. The Commodity Exchange Act, as originally enacted, contained a provision in which any product deemed to be an off-exchange futures contract could be declared illegal and void by a court of law. This legal quirk, together with some saber rattling by the CFTC’s former Chair, threatened the entirety of the multi-trillion dollar over-the-counter derivatives market.

To address this problem, in November 1999, the President’s Working Group on Financial Markets, which consisted of the Treasury Secretary Laurence Summers, Federal Reserve Board Chairman Alan Greenspan, SEC Chairman Arthur Levitt and CFTC Chairman Bill Rainer, proposed clarifying the jurisdiction of the CFTC by excluding certain over-the-counter derivatives from its jurisdiction. In determining whether the CFTC should have oversight authority, the PWG looked to whether products were being traded by retail customers, whether products were susceptible to manipulation and whether the participants were not otherwise regulated. The PWG believed that if these characteristics were not present, there was no public value in providing the CFTC with oversight that either was redundant or failed to meet its public mission.

In taking this tack, the PWG was using a framework that I like to call “smart regulation.” That’s the term of a fellow Hoosier and former Lugar chief of staff, current Office of Management and Budget Director Mitch Daniels. This regulatory approach, which is a cornerstone of my philosophy at the CFTC, provides that regulatory activity should be tailored to effectively meet the public interest without exacting unnecessary costs. This regulatory methodology does not presume more or less regulation. And in fact, the PWG found that there were certain markets needing more regulation and others needing less. For example, the PWG found that the CFTC should have jurisdiction over off-exchange retail foreign currency transactions. Since the enactment of this recommendation as part of the CFMA in 2000, the CFTC has opened 231 investigations into foreign exchange firms and successfully filed 25 cases, filling a regulatory gap that had been rife with bucket shops and abusive retail practices.

Applying the same “smart regulation” concept, the CFTC designed a tiered regulatory framework for on-exchange futures contracts. Products that were more susceptible to manipulation and were offered to the retail public, such as agricultural futures contracts, would be more heavily regulated. Those instruments that were less susceptible to manipulation and were offered only to sophisticated investors would benefit from a lighter regulatory touch. Ultimately, this regulatory reform proposal, along with the PWG’s findings on over-the-counter derivatives, became the first two legs of the Commodity Futures Modernization Act.

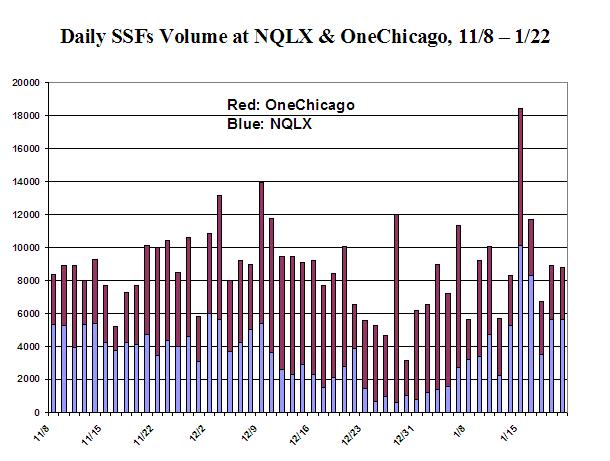

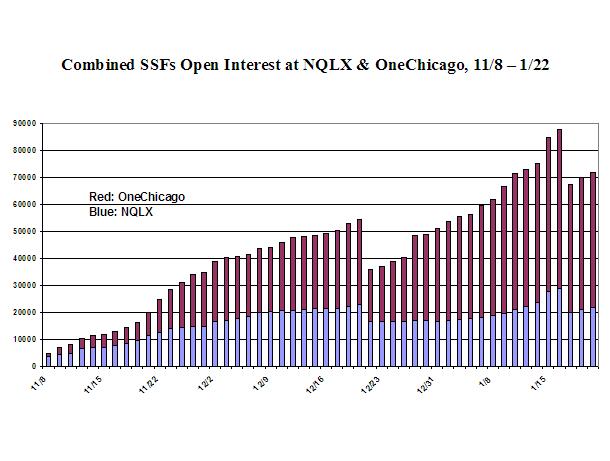

As many in the audience know, the third leg of the CFMA lifted the ban on security futures products and provided a joint regulatory framework for allowing the trading of these instruments. We are now seeing the fruits of this labor. Two electronic exchanges – OneChicago and NQLX – started operations last November 8, and I have been impressed by their activity to date. As you probably know, OneChicago is a consortium between Chicago’s big three exchanges: CBOE, CME and CBOT. NQLX is a joint effort between NASDAQ and LIFFE.

There has been no clear overall volume trend through the time for which we have data. There was a slight dip during the holiday period. Neither exchange has truly dominated, although OneChicago did have notably higher volume for several days in late 2002 and early this year.

We have seen a general growth in open interest at both exchanges, with slight dips around the holidays and in the last few days for which we have data. OneChicago has had greater open interest for most of the period since the first month of trading. Overall, the uptrend in open interest would suggest that there is substantial use of these products for hedging purposes, as opposed to mostly day-trading.

It is interesting to note that some in the trade expected that, because of the entities that combined to form the markets, OneChicago might attract more participation from people familiar with the futures markets, while NQLX might find a niche with those more accustomed to trading securities.

I want to congratulate both the SEC and CFTC, as well as the National Futures Association and other industry members who helped put together what seemed like an impossibility: a joint regulatory structure. I worked in the Senate when this process began in 1999, and you could hardly get the two agencies to talk to each other, let alone agree on something. However, since that time, both agencies, to their credit and benefit, have learned about each other’s industries and regulatory methodologies. As a result of these efforts, I believe that the regulatory structure that is in place is a good one and one that will provide this product with an excellent opportunity to succeed.

It should be noted that there is still important work to be done by our two agencies on this subject. In the CFMA, Congress instructed the SEC and CFTC to write joint rules for the trading of foreign narrow- and broad-based security futures products. Although no deadline is contained in the Act for completing the foreign narrow-based rule, I am confident that Congress intended these rules to be contemporaneous with the recent launching of the domestic trading of these products. Last spring, the CFTC offered the SEC an outline for proceeding with this rule making, and I am hopeful that the SEC and its soon-to-be Chairman William Donaldson will make this issue a priority.

After touching on several subjects, I want to leave you with an overview on how I plan to approach my decision-making over the remainder of my term at the CFTC. Although I am only one of four sitting Commissioners at the moment and much of our work is responsive to developments outside our control, I believe it is important to have clear, overarching objectives to guide us through our current challenges and, just as importantly, through upcoming issues we can only now imagine.

I have already mentioned the first of these guideposts: smart regulation. The CFTC must promote the idea that regulatory action should be tailored to effectively meet public goals without burdening market participants with unnecessary costs. As I said, the smart regulation approach does not necessarily mean more oversight or less. There will be times when the evidence, analysis and public sentiment justify a greater regulatory involvement. At other times, the opposite will be true. But in either event, regulators are obligated to weigh the costs to the public as well as the benefits of implementing regulations, and to do so in a timely, informed and open manner.

The smart regulation approach often leads us to market-based solutions for meeting our public objectives. That is because markets are often the most effective way of allocating resources in our society. One “smart” idea that is receiving a great deal of attention lately and one that I am personally intrigued by is the trading of credits to meet pollution-reduction goals. Both the President and Congress have introduced the idea of using credit trading as a market-based approach to help rid our air of pollutants. Although it is very early in the debate on this idea, I believe it will be valuable for the CFTC to participate in the ensuing policy discussion of how to trade credits in an economically and environmentally practical framework. Not because we will have jurisdiction over these issues – that may well not be the case – but because the CFTC and the industry participants it regulates know the inner workings of markets. Our industry understands which products succeed, which don’t, and why. This industry has had some experience with the trading of pollution credits in the past. The Chicago Board of Trade has held annual auctions of sulfur dioxide “allowances” since 1993. Should new market opportunities be created through pollution trading, I am confident that the CFTC and this industry will be well positioned to facilitate and add value to the discussion in some capacity. This would be an important use of the smart regulation strategy to which I am committed, and I will look forward to participating in it.

My second goal is to see greater coordination between regulators on market oversight. Regulators’ efforts should be arranged to ensure that oversight is justified by sound public policies and where it is needed, we should be certain no gaps or overlaps exist in our oversight structure. This will take a positive effort by our agency to reach out to other regulators and market participants to help in this coordination effort. As an example, on Wednesday of this week, our agency held a joint conference with the Federal Energy Regulatory Commission on the issue of credit risk in the energy markets. I am certain that these coordinated efforts between regulators will help educate the public on ways to improve the functioning and oversight of these important markets.

My last objective may seem obvious but I think its one worth stating. The CFTC must continually strive to do a better job at serving its customers – whether it is the public in general or the industry it regulates. With the clarification of CFTC’s goals and jurisdiction in the CFMA, our agency has a wonderful opportunity to clearly focus its oversight time and resources to meeting the specific missions set out by Congress. I am pleased to point out that the CFMA allows the industry to choose its regulators in certain circumstances. I believe that choice is an important characteristic of the smart regulation approach and it makes our agency more accountable for its actions. As long as the public interest is being served, regulatory choice is a healthy way to ensure competing agencies do their jobs in the most effective manner possible. Inevitably, this comparison will cause the CFTC to improve the way it conducts business. I believe this to be healthy, and I look forward to this measurement.

In meeting this goal of better serving the public, we also must strive to have the “best and the brightest” at CFTC. Talented, energetic individuals are key to our success and we must improve and promote our working environment. I must say that in the several months I have been at the Commission, I have been impressed by the quality of the employees and their work product. Retaining and building on this valued workforce is part of the reason why we need the “pay parity” I discussed earlier.

All of these goals, taken independently, are important. But the net benefit will be greater than the sum of the parts. These guideposts will enable me to successfully navigate the challenges that lay ahead for the Commission and this industry. Over the remainder of my term, I hope that I can be a small part in making sure that our nation remains a world leader in this business.